August Global Fund Managers' Consensus List: What to Overweight? What to Underweight?

Shifting Market Sentiment: Global Fund Managers Pivot from European Stocks to Emerging Markets While Boosting Bets on US Equities and the Magnificent Seven

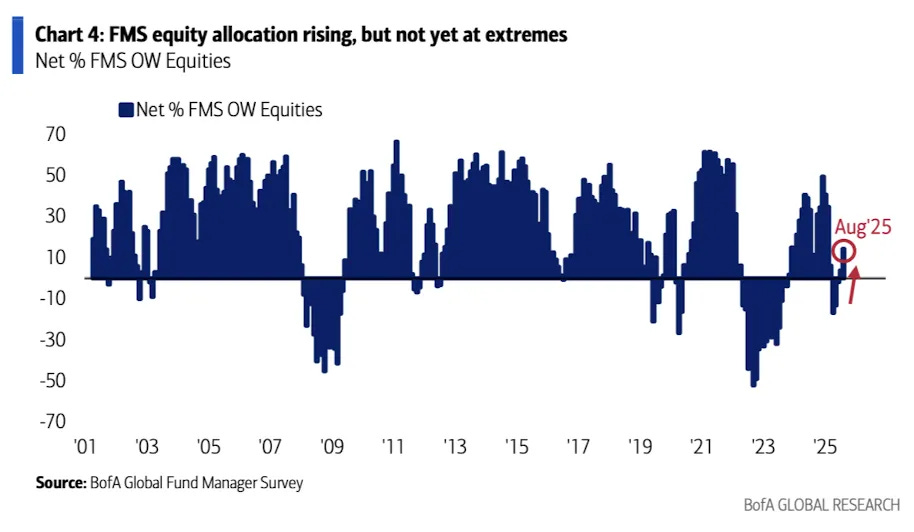

The July Fund Manager Survey (FMS) showed market sentiment turning fully optimistic, with the latest August survey reinforcing this bullish signal even further.

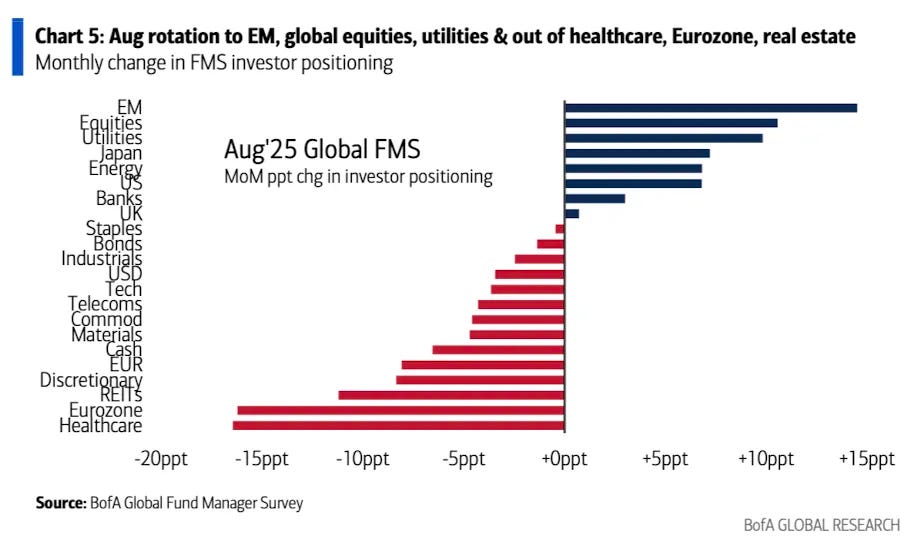

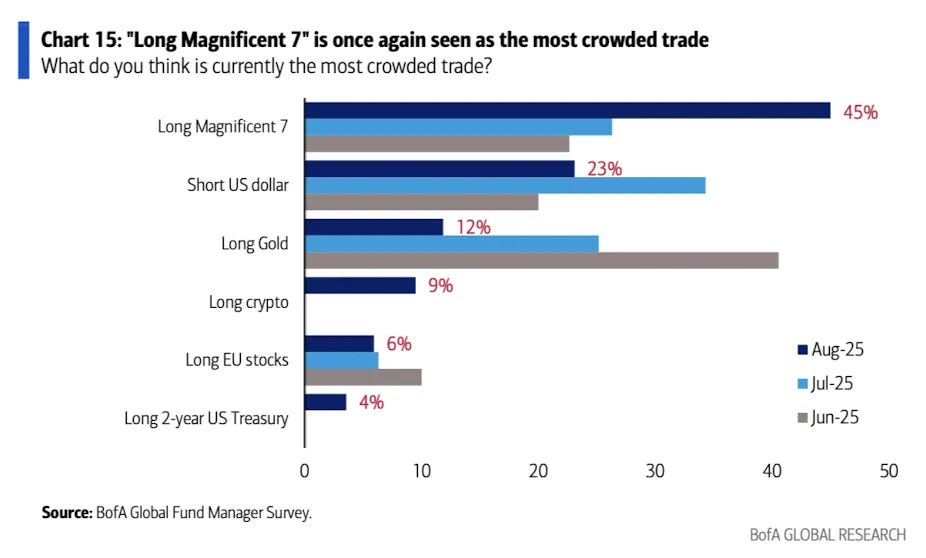

Several key shifts stand out: Global fund managers are pulling capital out of European stocks and reallocating it to emerging markets. They are also continuing to overweight U.S. equities, with positioning in the "Magnificent Seven" now surpassing short-dollar bets to become the most crowded trade once again.

Even as European investors take a cautious view of their local markets in the short term, they stay bullish over the longer horizon. At the same time, one unchanging trend is that both global and European investors are trimming cash holdings and remaining bearish on the dollar.

For retail investors, these findings are essential. They not only shed light on how professionals are positioning their assets but also serve as a key indicator of capital flows and market expectations, helping to pinpoint potential trends and opportunities across regions and sectors.

Global Fund Managers' Perspective: Shifting from European Stocks to Emerging Markets

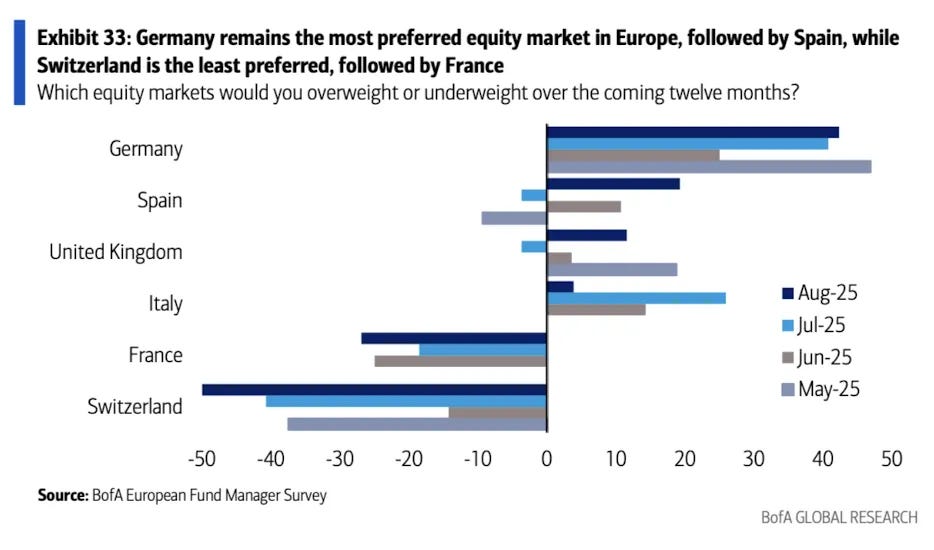

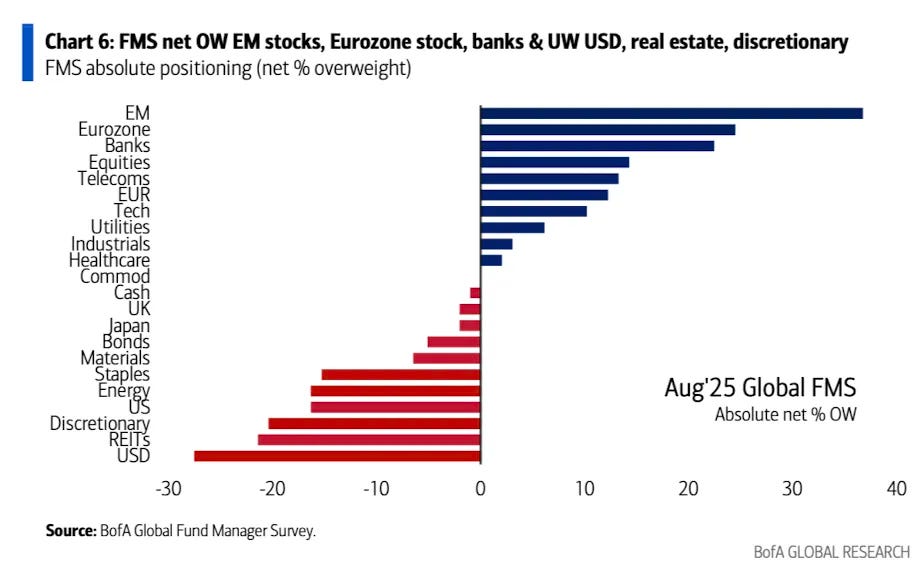

FMS net OW EM stocks, Eurozone stock, banks & UW USD, real estate, discretionary.

Aug rotation to EM, global equities, utilities & out of healthcare, Eurozone, real estate.

FMS equity allocation rising, but not yet at extremes.

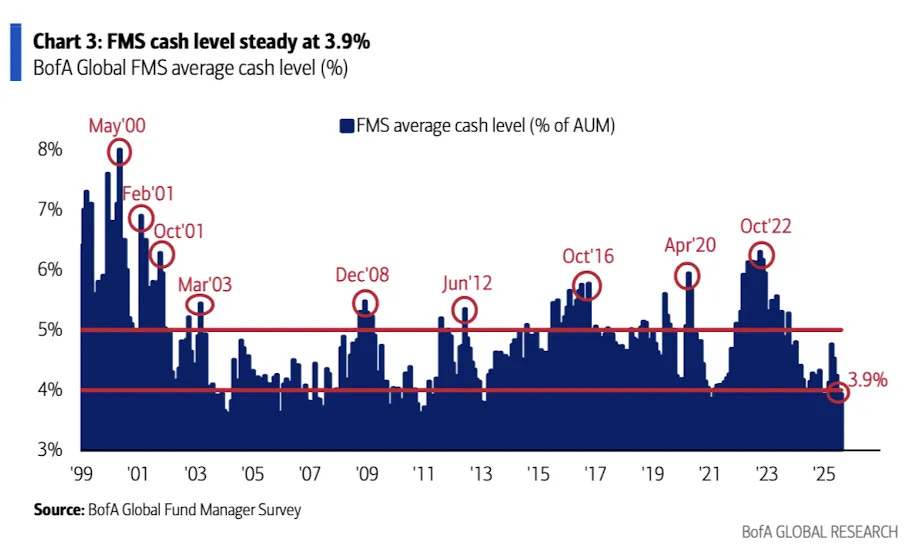

FMS cash level steady at 3.9%.

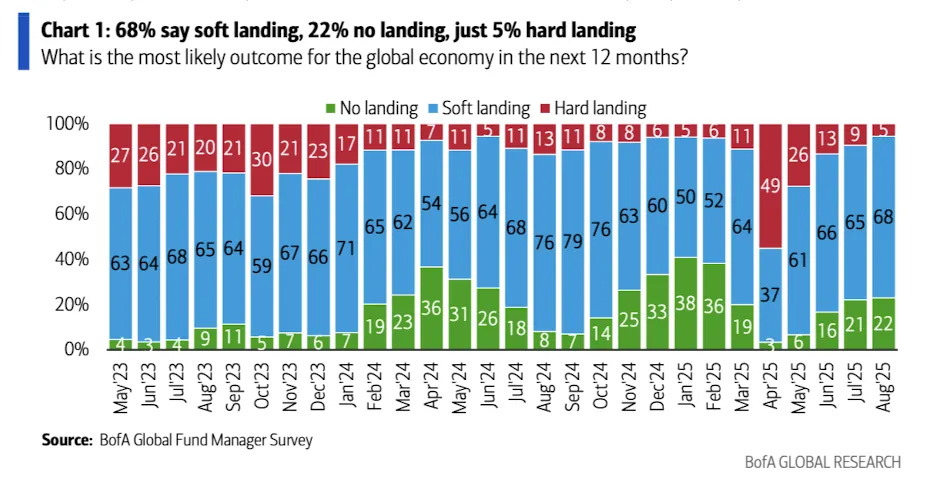

68% say soft landing, 22% no landing, just 5% hard landing.

August pullback in growth expectations.

The chart shows the trends of the net percentage expecting a stronger global economy (dark blue line) and the YoY change of the S&P 500 index (light blue line) from 1994 to 2024, including the data point of Aug'25

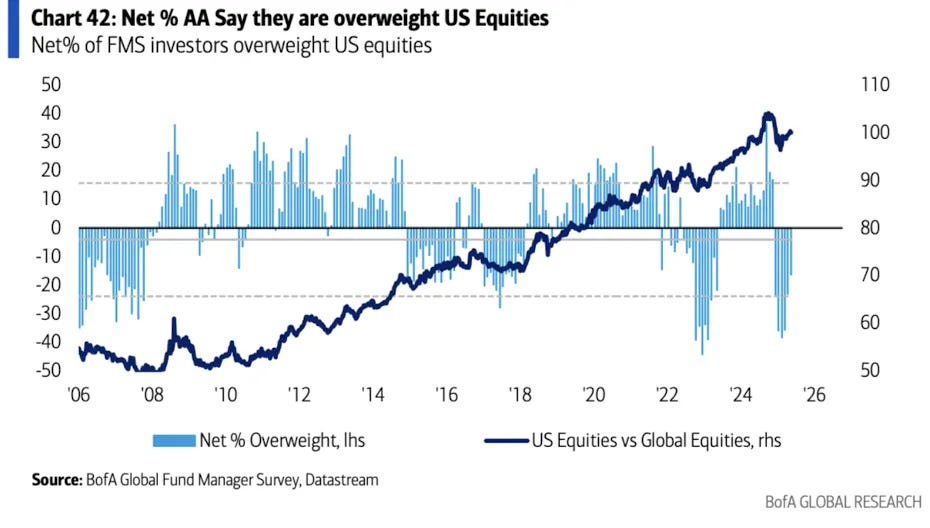

Net % AA Say they are overweight US Equities.

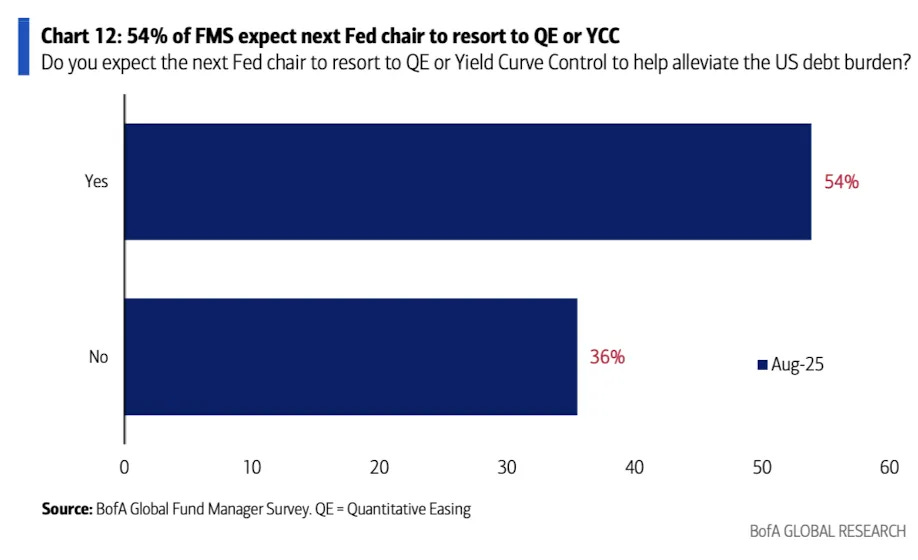

54% of FMS expect next Fed chair to resort to QE or YCC.

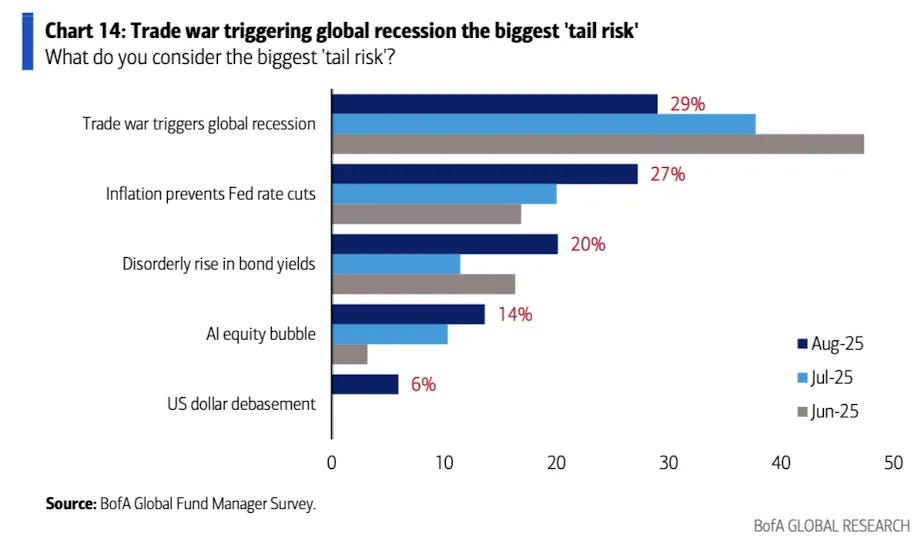

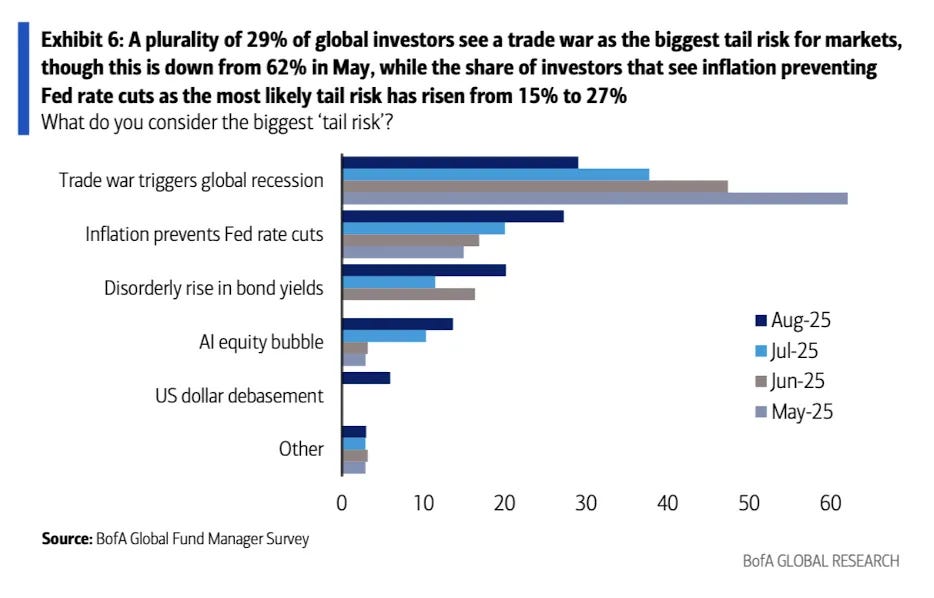

Trade war triggering global recession the biggest 'tail risk'.

"Long Magnificent 7" is once again seen as the most crowded trade.

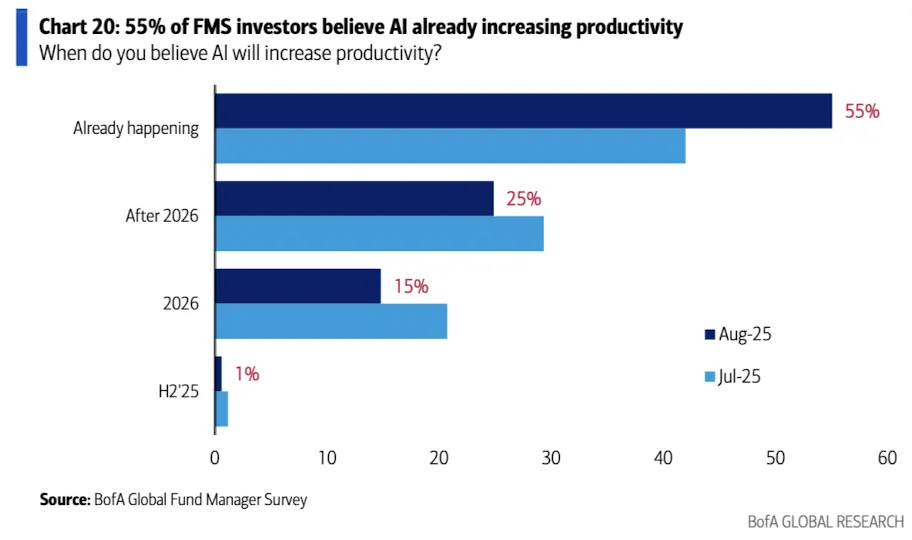

55% of FMS investors believe AI already increasing productivity.

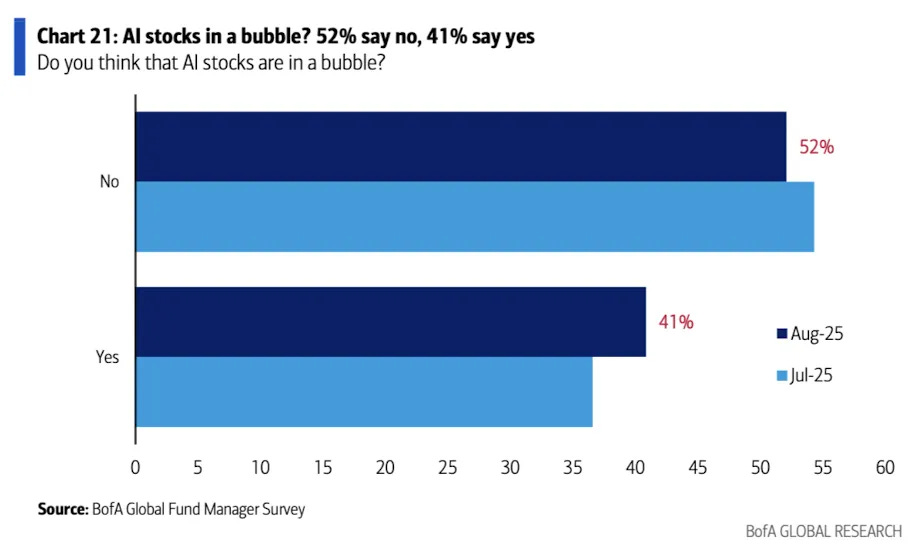

AI stocks in a bubble? 52% say no, 41% say yes.

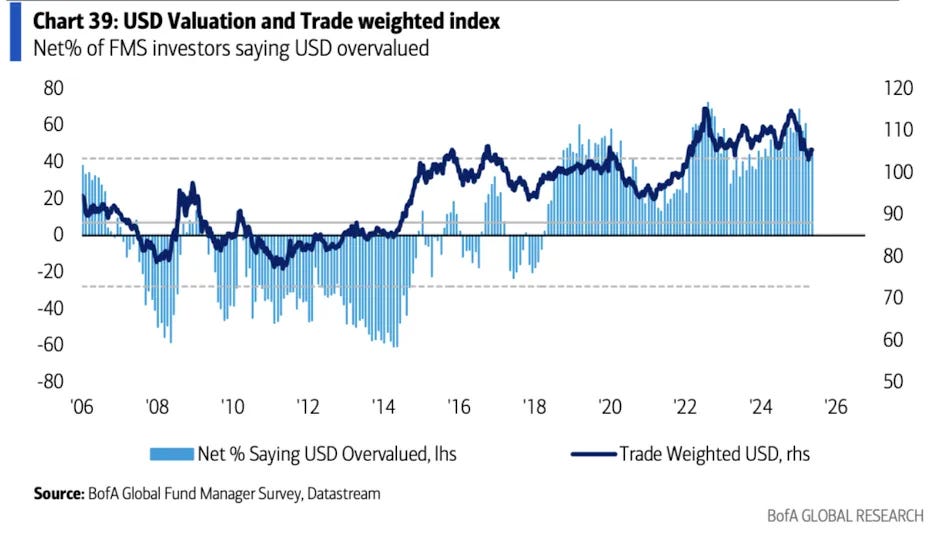

USD Valuation and Trade weighted index.

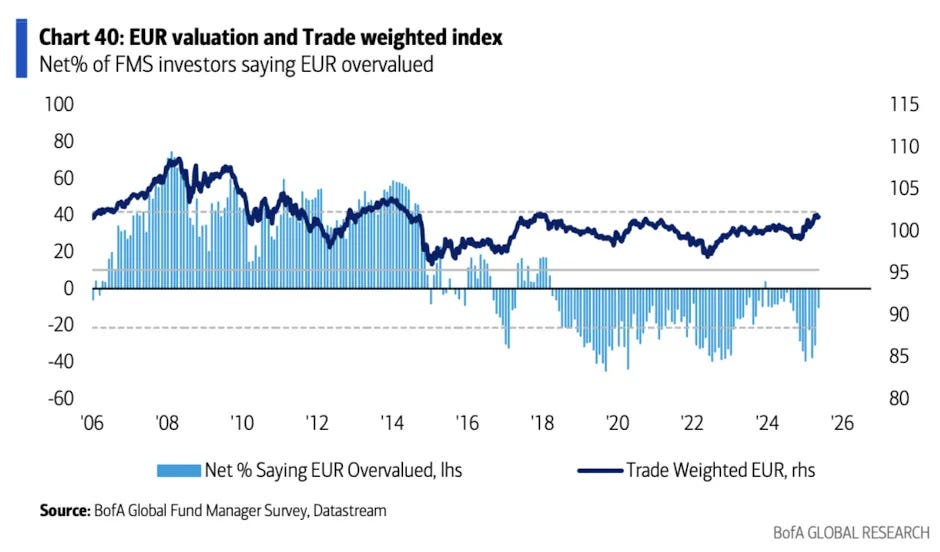

EUR valuation and Trade weighted index.

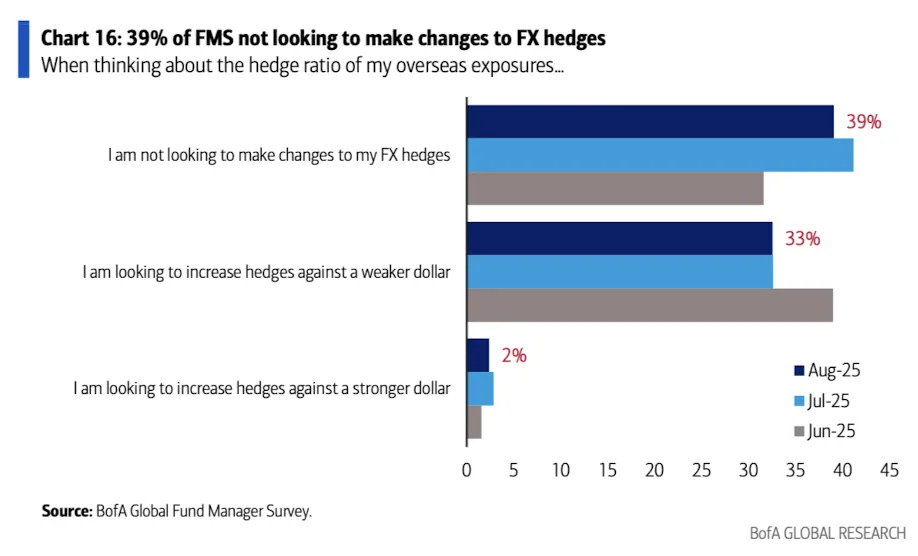

39% of FMS not looking to make changes to FX hedges.

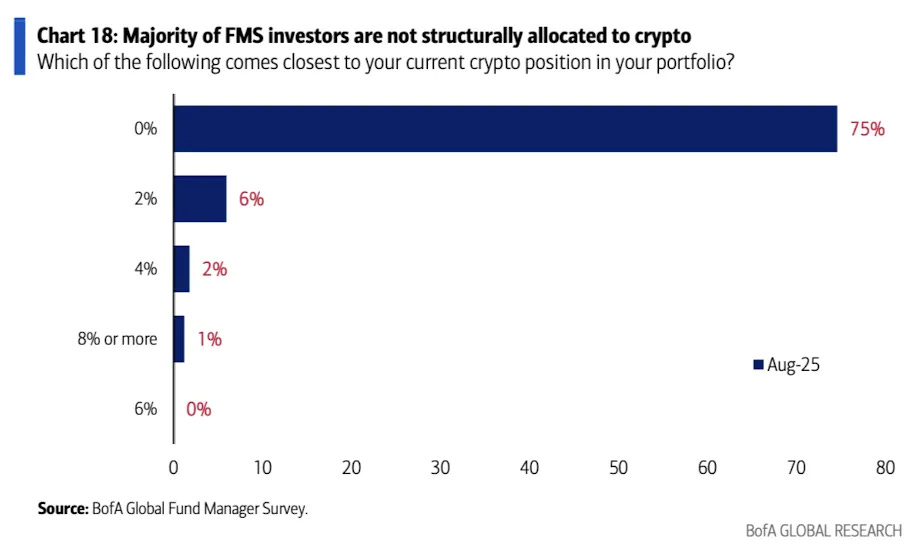

Majority of FMS investors are not structurally allocated to crypto.

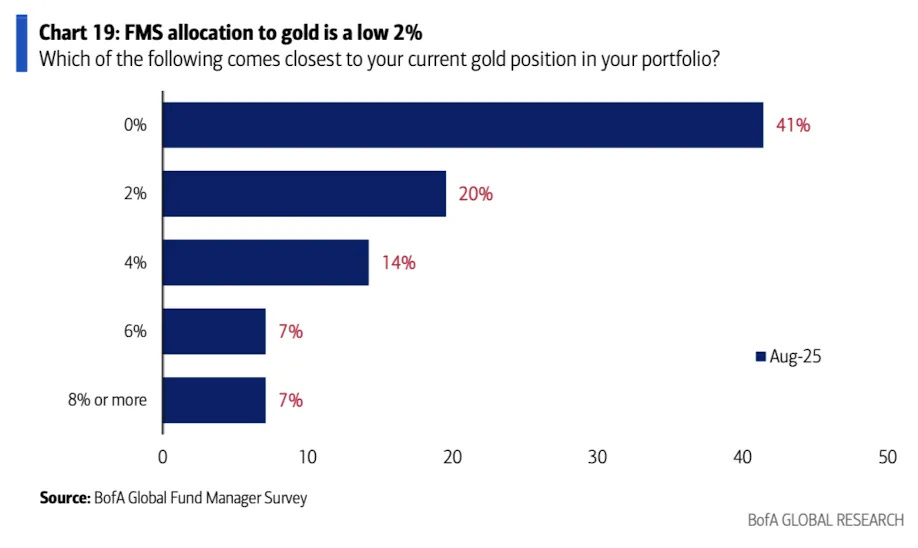

FMS allocation to gold is a low 2%.

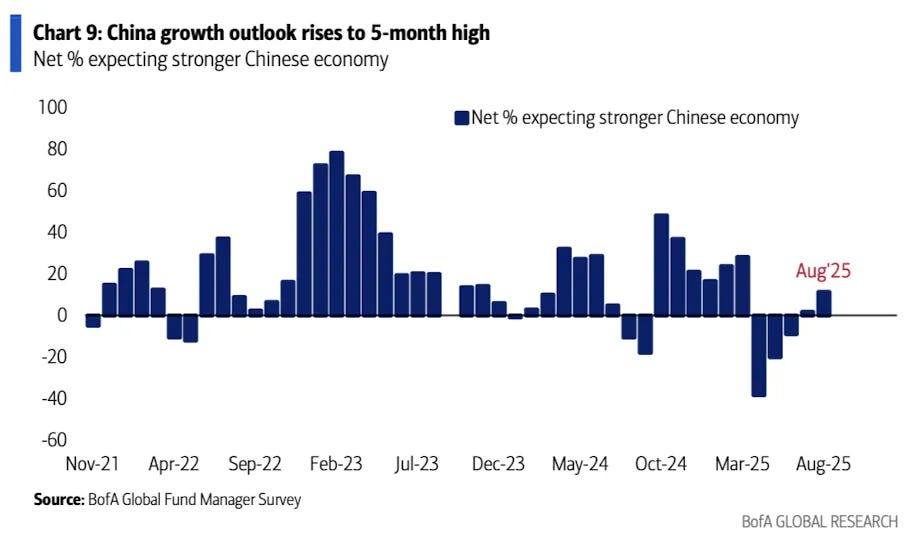

China growth outlook rises to 5 - month high.

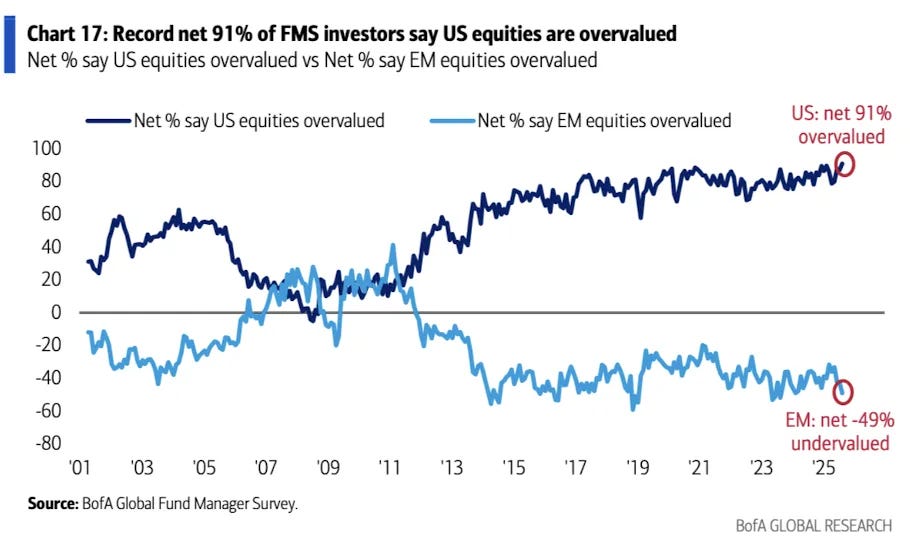

Record net 91% of FMS investors say US equities are overvalued.

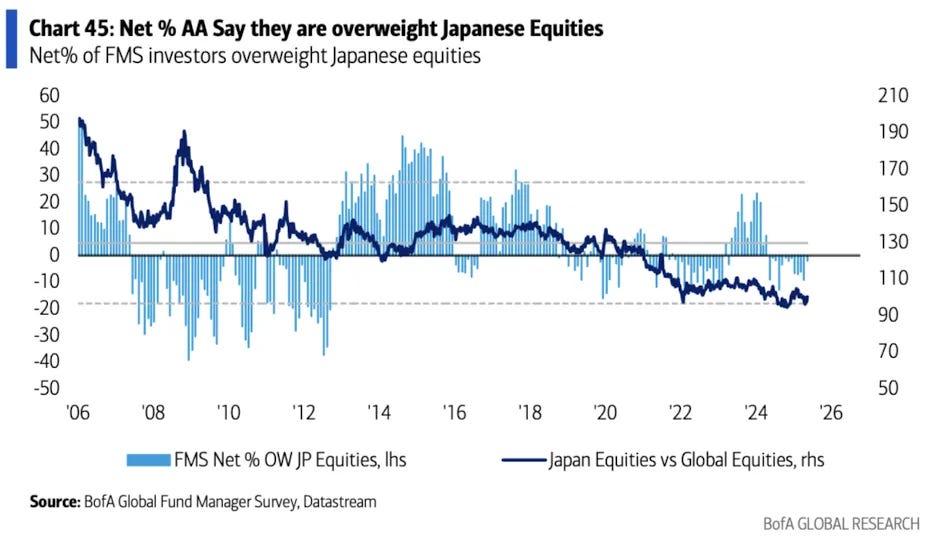

Net % AA Say they are overweight Japanese Equities.

European Fund Managers' Perspective: Bearish on EU Stocks in the Short Term but Bullish Long Term

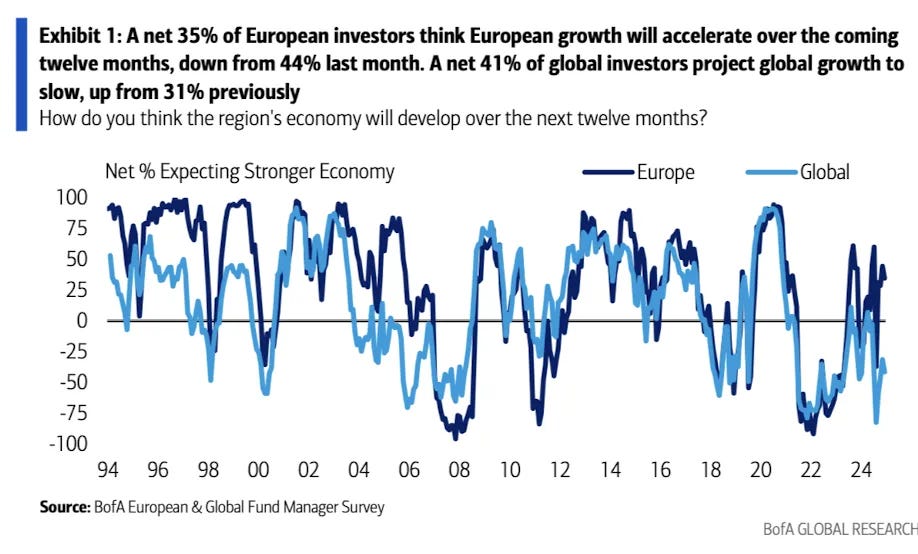

A net 35% of European investors think European growth will accelerate over the coming twelve months, down from 44% last month. A net 41% of global investors project global growth to slow, up from 31% previously.

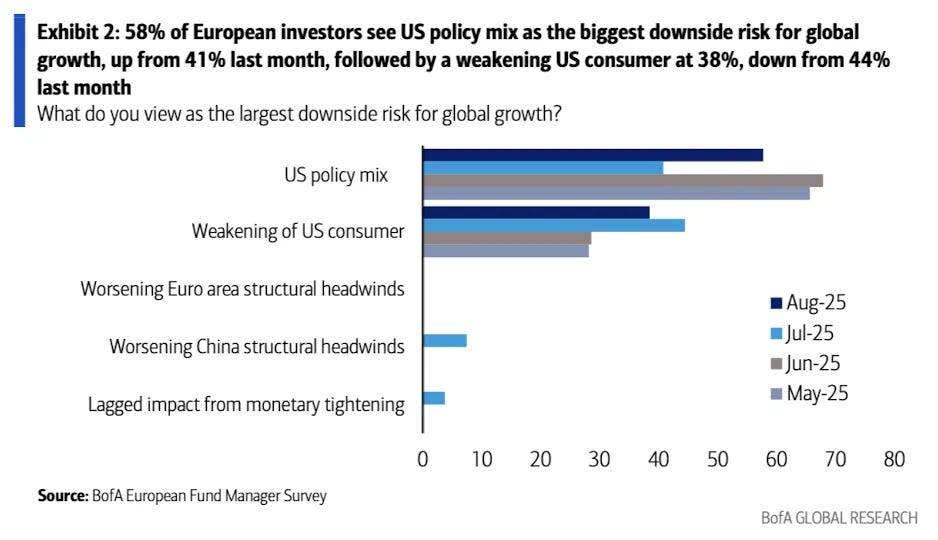

58% of European investors see US policy mix as the biggest downside risk for global growth, up from 41% last month, followed by a weakening US consumer at 38%, down from 44% last month.

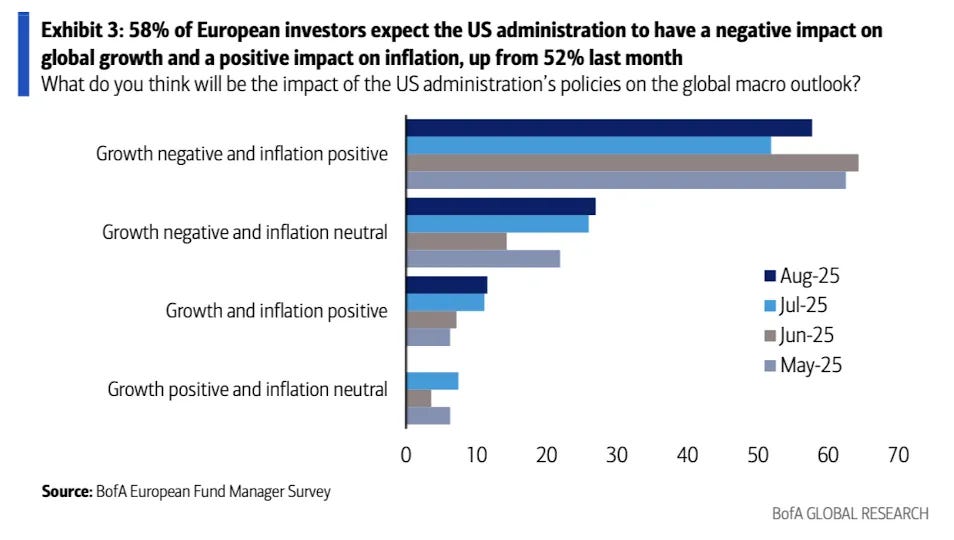

58% of European investors expect the US administration to have a negative impact on global growth and a positive impact on inflation, up from 52% last month.

A plurality of 29% of global investors see a trade war as the biggest tail risk for markets, though this is down from 62% in May, while the share of investors that see inflation preventing Fed rate cuts as the most likely tail risk has risen from 15% to 27%.

A net 18% of global investors expect higher core inflation globally over the coming twelve months, up from 6% last month, while a net 23% expect lower core inflation in Europe versus a net 4% that expected higher inflation last month.

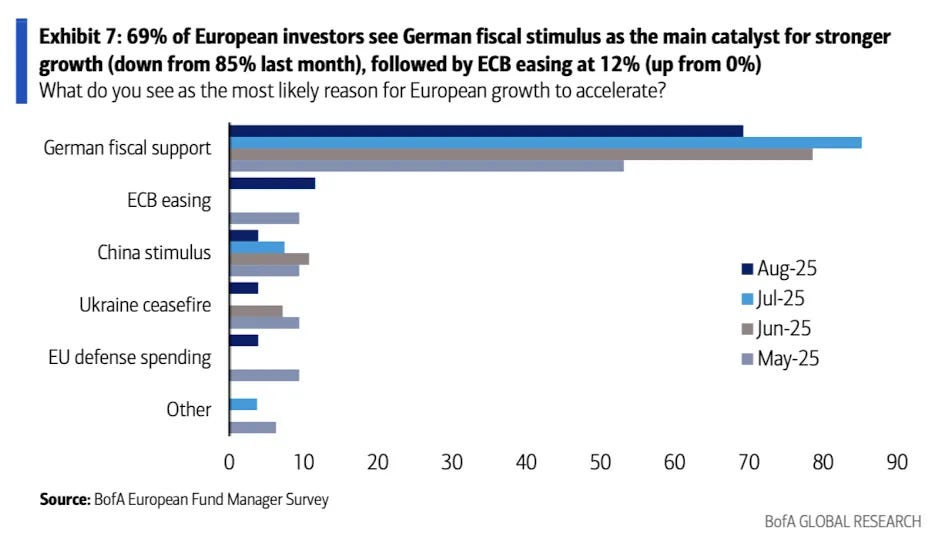

69% of European investors see German fiscal stimulus as the main catalyst for stronger growth (down from 85% last month), followed by ECB easing at 12% (up from 0%).

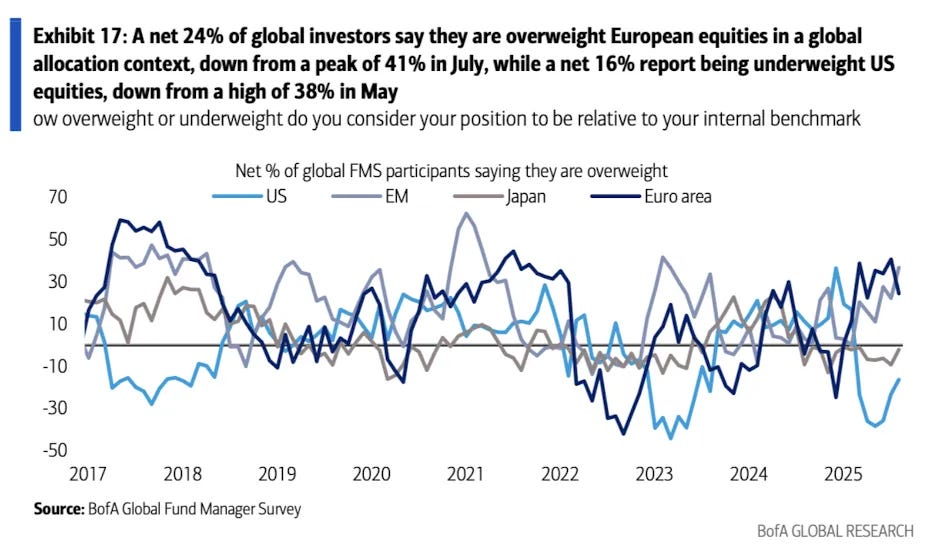

A net 24% of global investors say they are overweight European equities in a global allocation context, down from a peak of 41% in July, while a net 16% report being underweight US equities, down from a high of 38% in May.

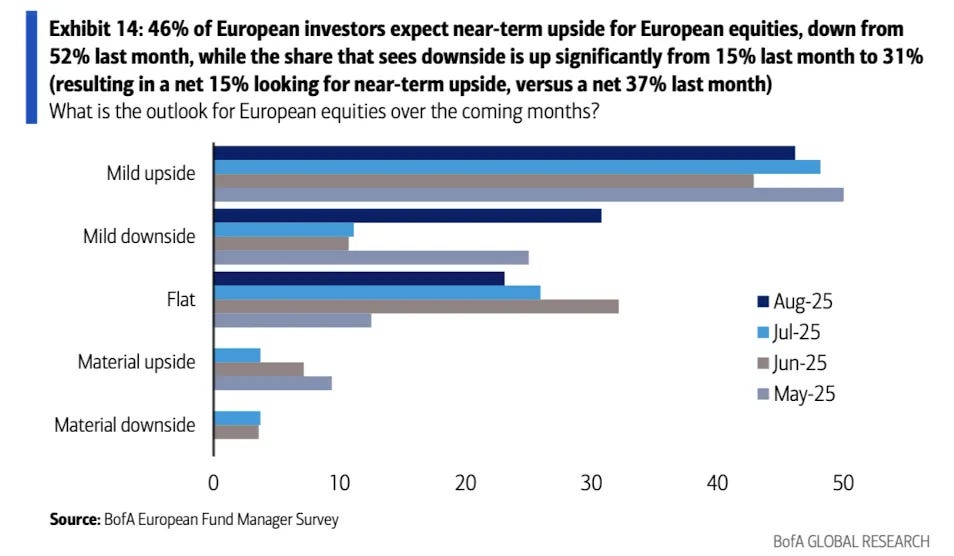

46% of European investors expect near-term upside for European equities, down from 52% last month, while the share that sees downside is up significantly from 15% last month to 31% (resulting in a net 15% looking for near-term upside, versus a net 37% last month).

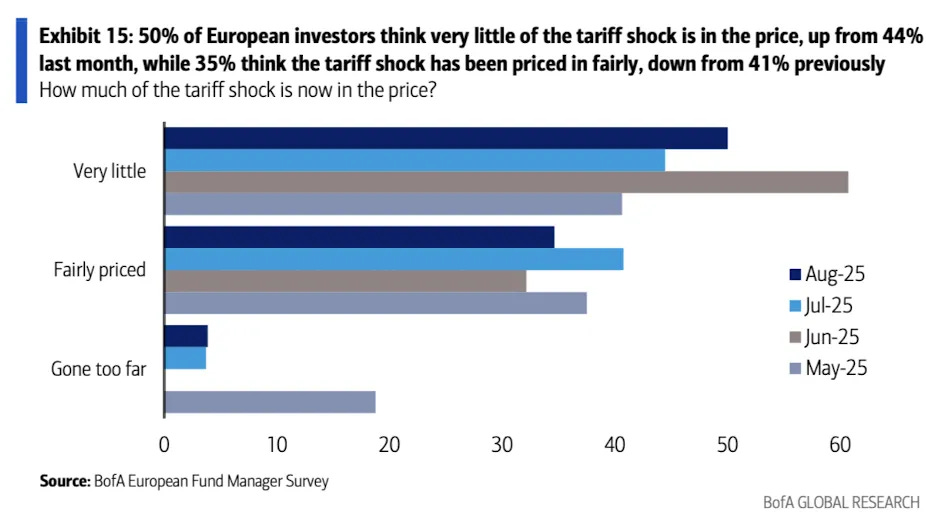

50% of European investors think very little of the tariff shock is in the price, up from 44% last month, while 35% think the tariff shock has been priced in fairly, down from 41% previously.

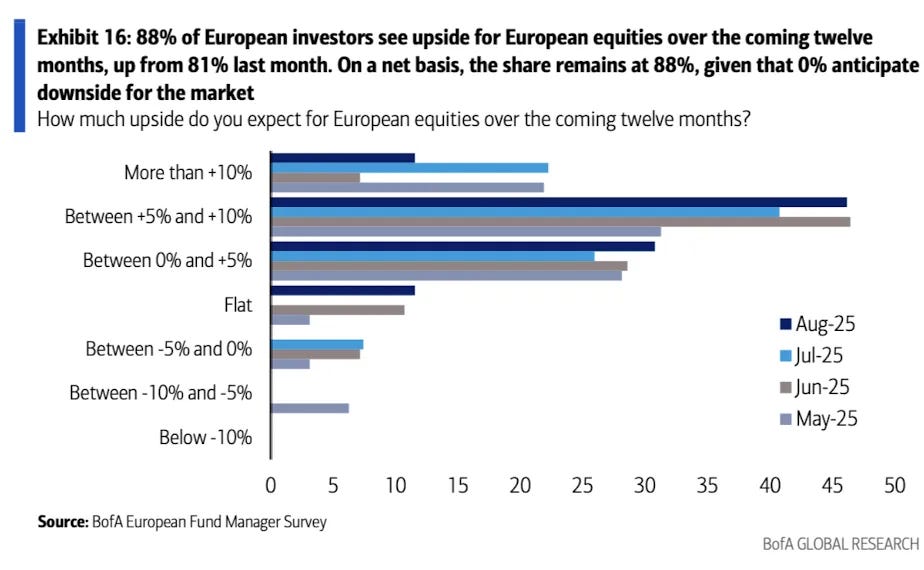

88% of European investors see upside for European equities over the coming twelve months, up from 81% last month. On a net basis, the share remains at 88%, given that 0% anticipate downside for the market.

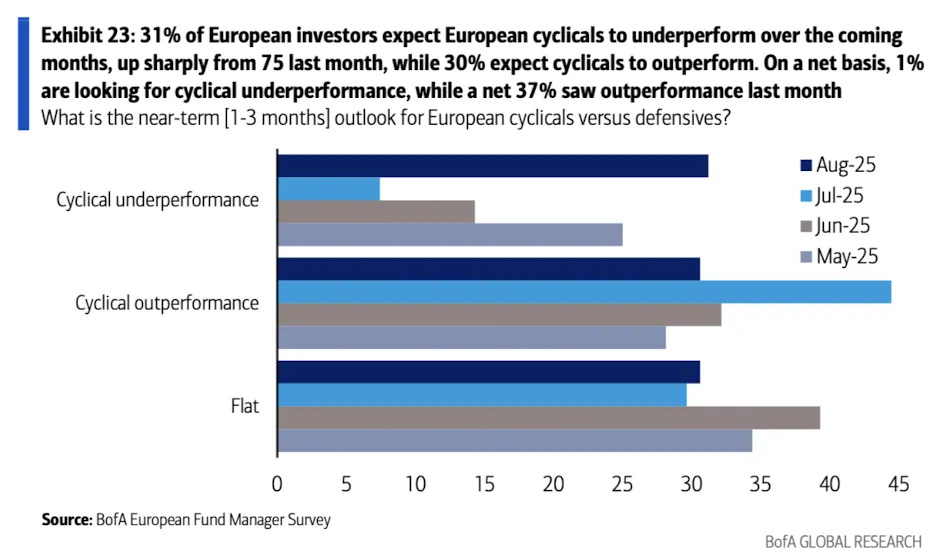

31% of European investors expect European cyclicals to underperform over the coming months, up sharply from 75 last month, while 30% expect cyclicals to outperform. On a net basis, 1% are looking for cyclical underperformance, while a net 37% saw outperformance last month.

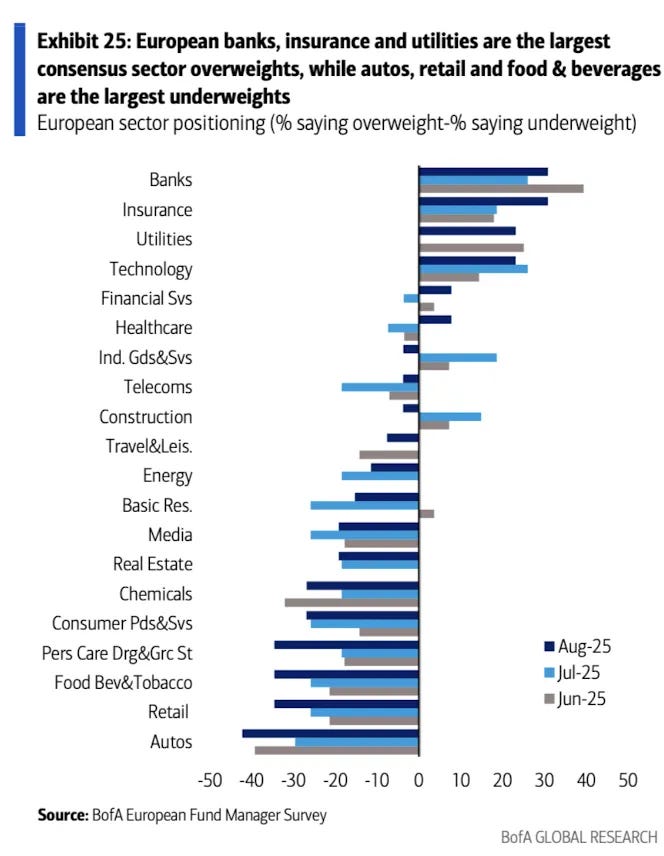

European banks, insurance and utilities are the largest consensus sector overweights, while autos, retail and food & beverages are the largest underweights.

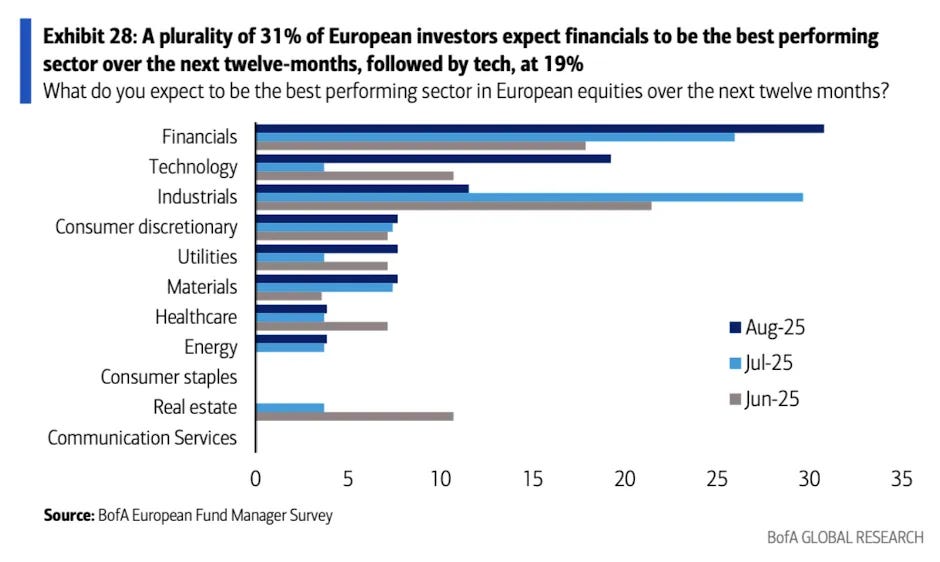

A plurality of 31% of European investors expect financials to be the best performing sector over the next twelve-months, followed by tech, at 19%.

Germany remains the most preferred equity market in Europe, followed by Spain, while Switzerland is the least preferred, followed by France.

The chart shows the change in the difference of overweight/underweight for various European equity markets over the next twelve months in BofA European Fund Manager Survey from May to Aug 2025