Beyond Gold: Navigating Stagflation Risks with Smart Commodity Diversification

In a Post-Globalization Landscape, Nations Leverage Concentrated Resources for Geopolitical Power, Compelling Investors to Diversify into Energy, Metals, and Minerals to Counter Supply Shocks and Infl

The End of the Globalization Era

Over the past few decades, we've grown accustomed to a narrative of globalization: goods flowing freely across borders, with supply chains spanning the globe.

But that era quietly came to an end after the 2008 financial crisis. In its place, we've seen the rise of a new order where nations prioritize their own interests first—securing domestic needs before engaging in trade.

Countries aren't just safeguarding their critical supply chains; they're also turning excess capacity into leverage to influence others.

Today, whether it's U.S. natural gas exports or China's rare earth refining, these resources have become highly concentrated and are increasingly deployed in geopolitical maneuvering.

This shift has directly heightened the risks of global supply disruptions and inflationary pressures.

Therefore, when we discuss hedging risks in investment portfolios today, the solution may no longer lie in the traditional balance between stocks and bonds, but rather in those commodities that are being "weaponized" at an accelerating pace.

Given the trends toward concentration and leverage in commodity supplies, portfolios should incorporate diversified commodity allocations to hedge against these risks.

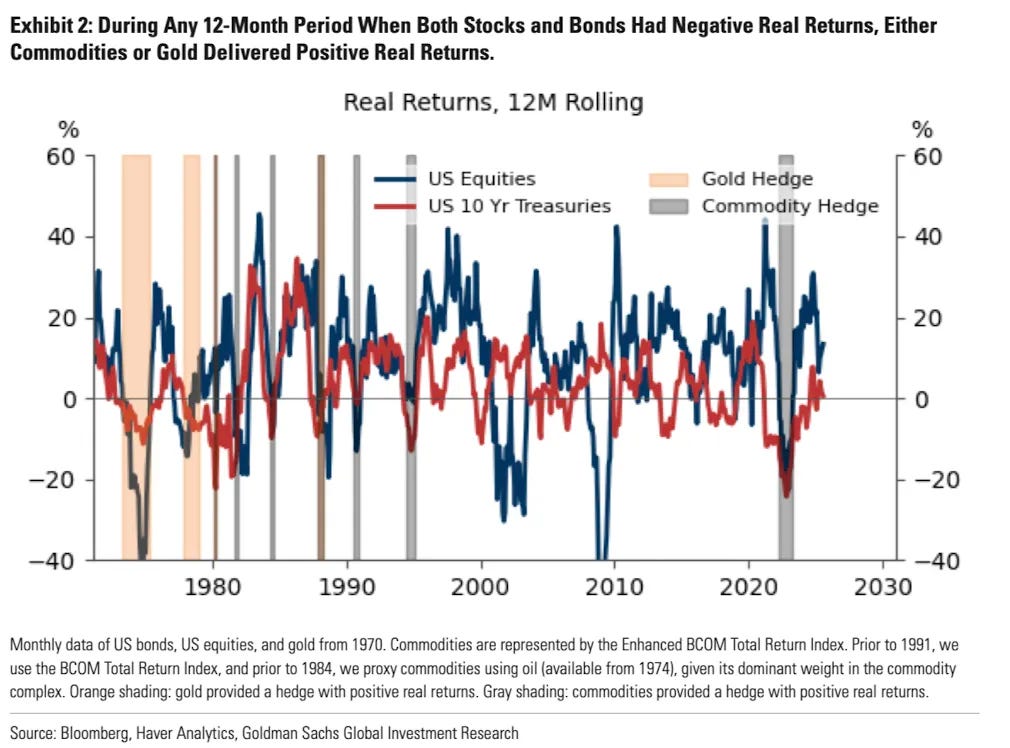

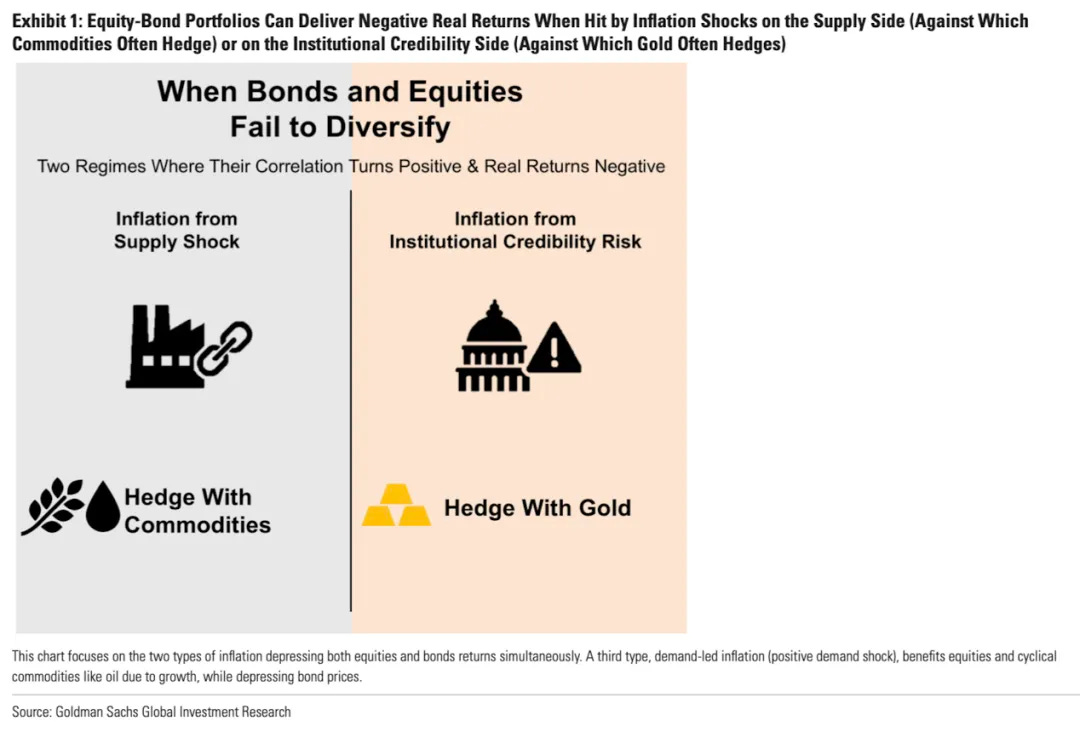

Stock-bond portfolios underperform in two distinct stagflation regimes (see Figure 1; Figure 2).

The first arises amid eroding confidence in U.S. institutions. When markets question the central bank's commitment or capacity to contain inflation, inflation becomes unanchored, fueling a upward spiral that drags down both equities and fixed income.

The 1970s offer a textbook case: expansive U.S. fiscal policies and the Federal Reserve's diminished independence allowed inflation to run rampant, propelling gold higher as a refuge for investors pursuing value beyond the established system.

The second stems from supply-side shocks, which stifle economic growth while propelling prices upward. The events of 2022 illustrate this vividly: Russia halted natural gas deliveries to Europe, a supply that had previously represented 40% of the region's total consumption.

In the end, it was precisely these commodities—such as natural gas, facing acute supply disruptions—that stood out as among the rare assets generating positive real returns in the markets that year.

This year, strategies for hedging portfolio risks with gold have once again drawn significant attention. This trend became particularly pronounced after Emancipation Day in April, when both bond and equity markets tumbled, amid resurfacing concerns over the Federal Reserve's independence.

However, as commodity supplies grow increasingly concentrated and are wielded more frequently as levers of influence, diversifying investments across a broader range of commodities may prove equally essential.

The Stalling of Globalization and Rising Volatility

Prior to 2008, globalization reduced production costs and bolstered supply stability, yielding global inflation that was not only low but also exceptionally steady.

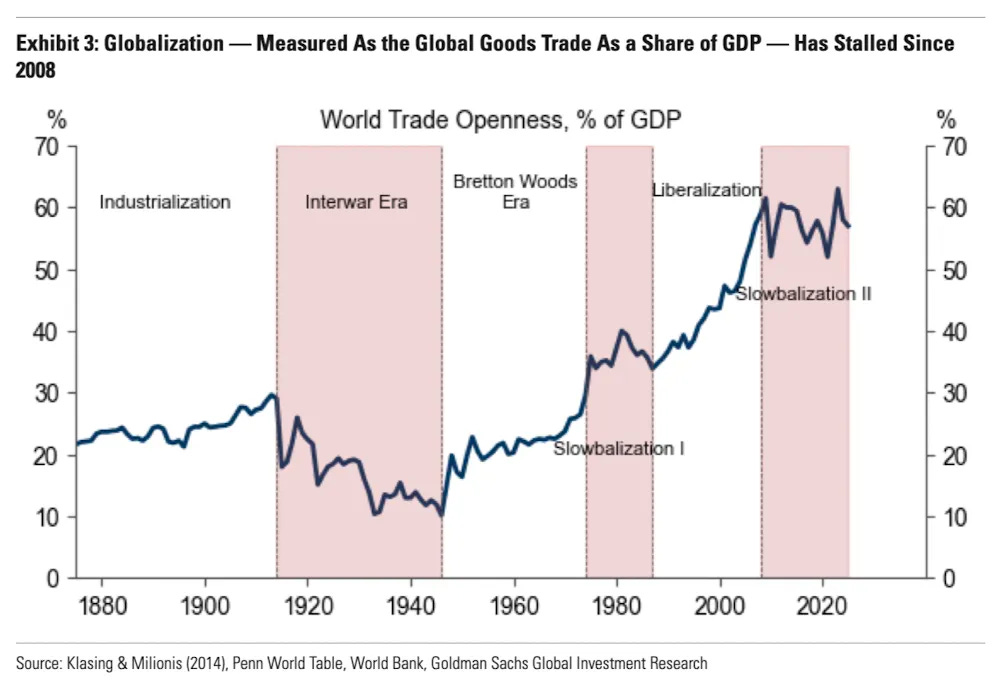

However, in the years following 2008, the advance of globalization ground to a halt—a shift discernible in the evolving share of global goods trade as a percentage of world GDP (see Figure 3).

This dynamic has dismantled the longstanding buffering effect of supply chains, thereby intensifying volatility in production costs and prices. As a result, inflation has grown higher, more persistent, and far more challenging to forecast.

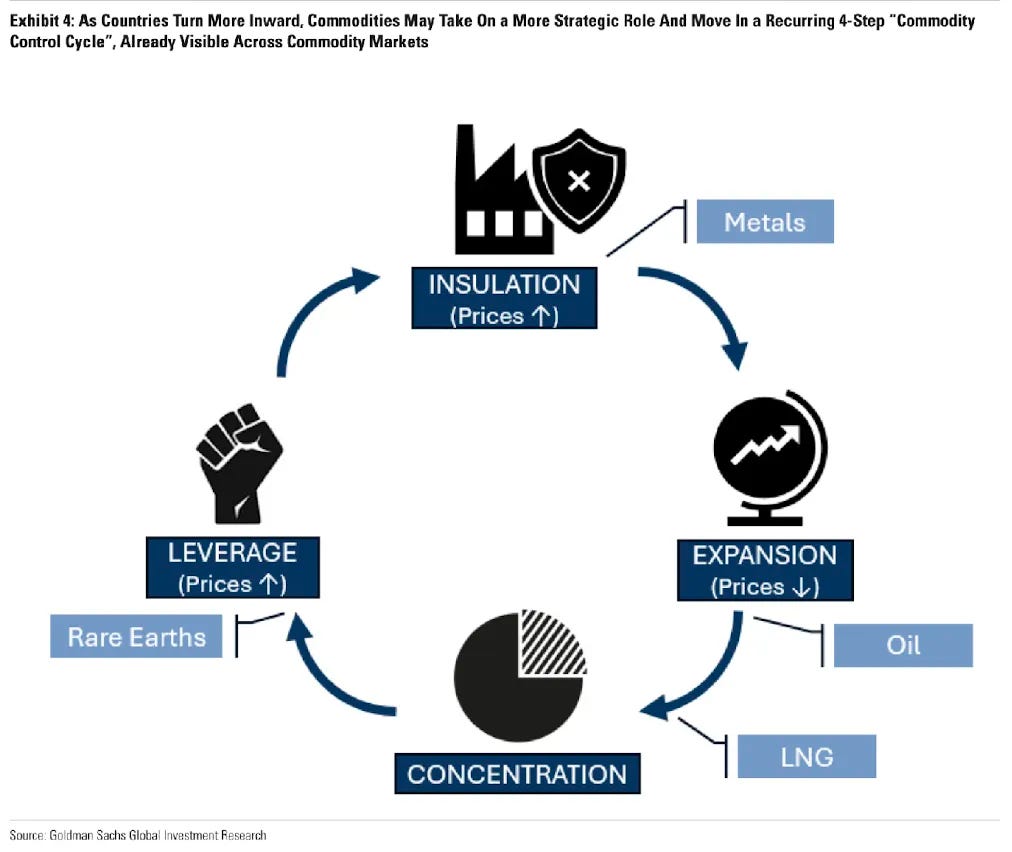

As national policies increasingly pivot inward, commodities are likely to take on a more strategic dimension, ushering in a recurring four-step "commodity control cycle" (see Figure 4):

To safeguard domestic supply chains, governments deploy tariffs, subsidies, and investments to drive production reshoring. The objective is clear: substitute imports wherever feasible, and build strategic reserves for those that cannot be replaced.

Once domestic supplies expand and stabilize, excess capacity shifts toward exports.

As global commodity prices decline, higher-cost producers are compelled to exit the market, leading to a gradual concentration of supply among a handful of dominant players.

With supplies consolidated, these leading producers can leverage their market position as a geopolitical and economic influence. By imposing export restrictions and similar measures, they exacerbate risks of supply disruptions, price volatility, and inflation—ultimately prompting other nations to act in defense of their own supply chains.

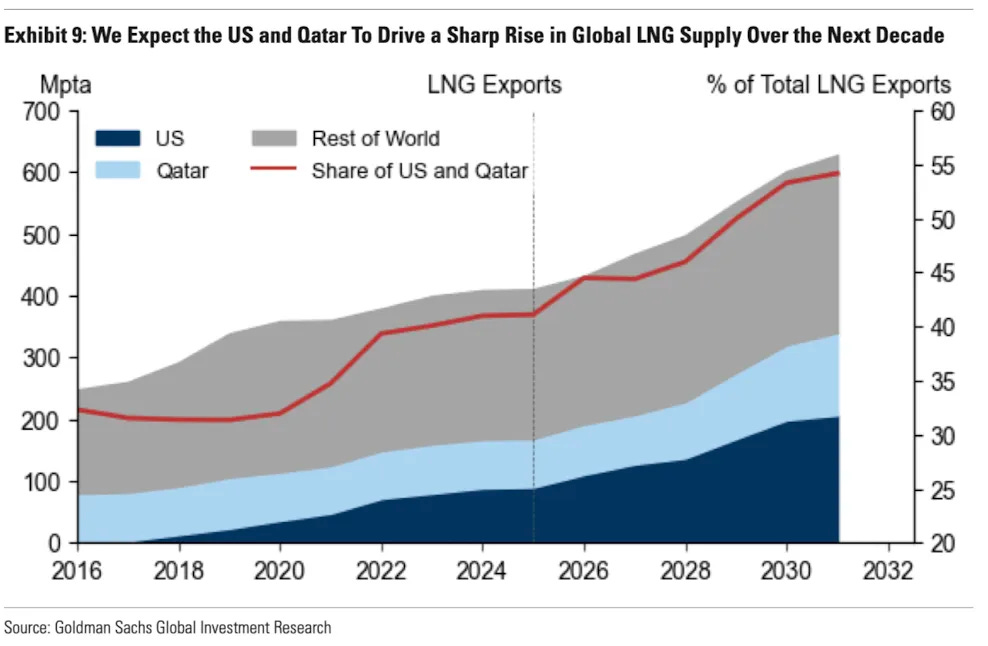

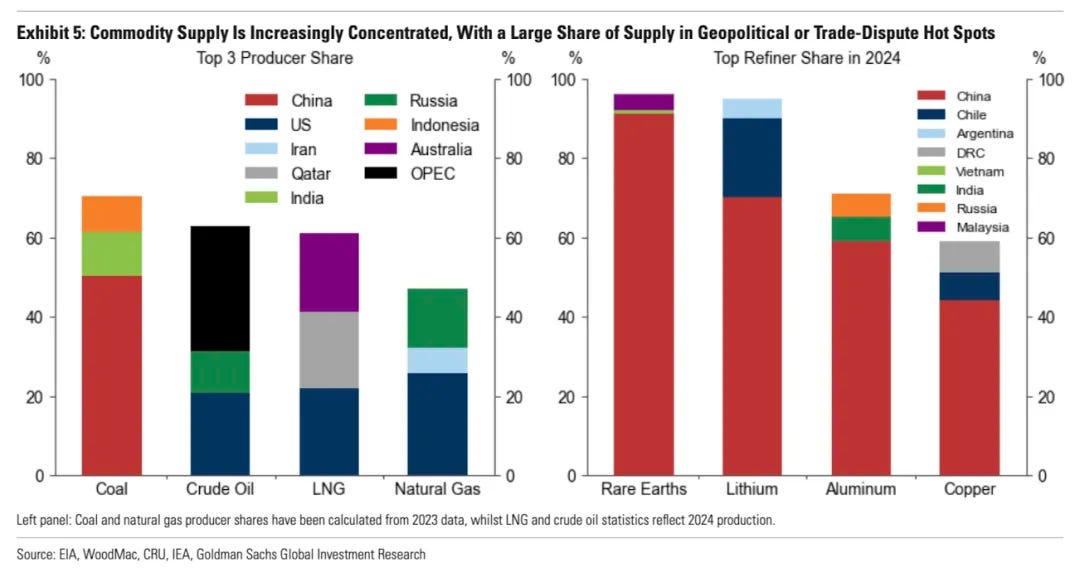

Commodity supplies are increasingly concentrated in regions rife with geopolitical tensions or trade disputes (see Figure 5). By 2030, the United States is projected to supply more than one-third of global liquefied natural gas (LNG), and it is linking energy exports more frequently to tariff negotiations—thereby amplifying allies' dependence on U.S. deliveries.

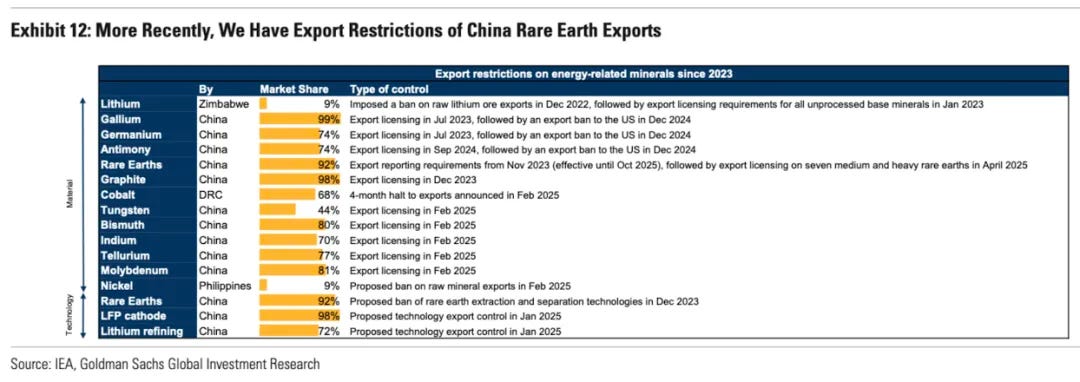

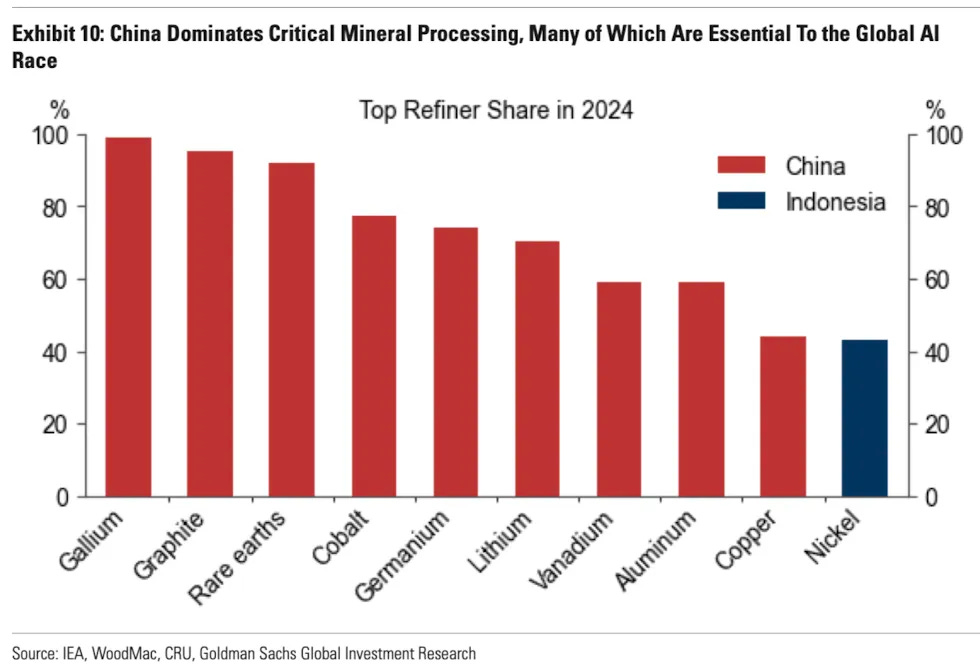

China maintains a dominant role in critical mineral processing, commanding over 90% of worldwide rare earth refining, which is pivotal to the AI race, and it tightened export regulations earlier this year.

The rising utilization of commodities as strategic levers could bolster the merits of commodity diversification within investment portfolios.

Key Factors for Effective Commodity Hedges

In other words, not all commodities function equally well as hedges for investment portfolios; their efficacy depends on whether the commodity forms part of the underlying market disruption, and whether that disruption carries an inflationary character while affecting broader economic activity.

Two factors prove critical:

The commodity's direct or indirect weighting in the inflation basket.

The proportion of supply subject to interruption.

Energy excels on both counts, as it has historically and continues to do so today.

Industrial metals and rare earths score lower overall, even as their relevance grows amid the transition of energy systems from fossil fuels to renewables.

However, on the second factor, industrial metals and rare earths exhibit a particularly striking feature: their refining stages are overwhelmingly concentrated in China.

Thus, even if these materials exert only an indirect influence on inflation (for instance, as inputs in automobile manufacturing), any interruption in the rare earth refining process—which handles roughly 90% of global production—could nonetheless trigger substantial economic shocks.

Protection

In 2018, the United States levied tariffs on steel and aluminum, invoking national security concerns. This resulted in reduced imports, elevated market prices, and a modest uptick in domestic output. These tariffs were reinstated earlier this year at a 50% rate.

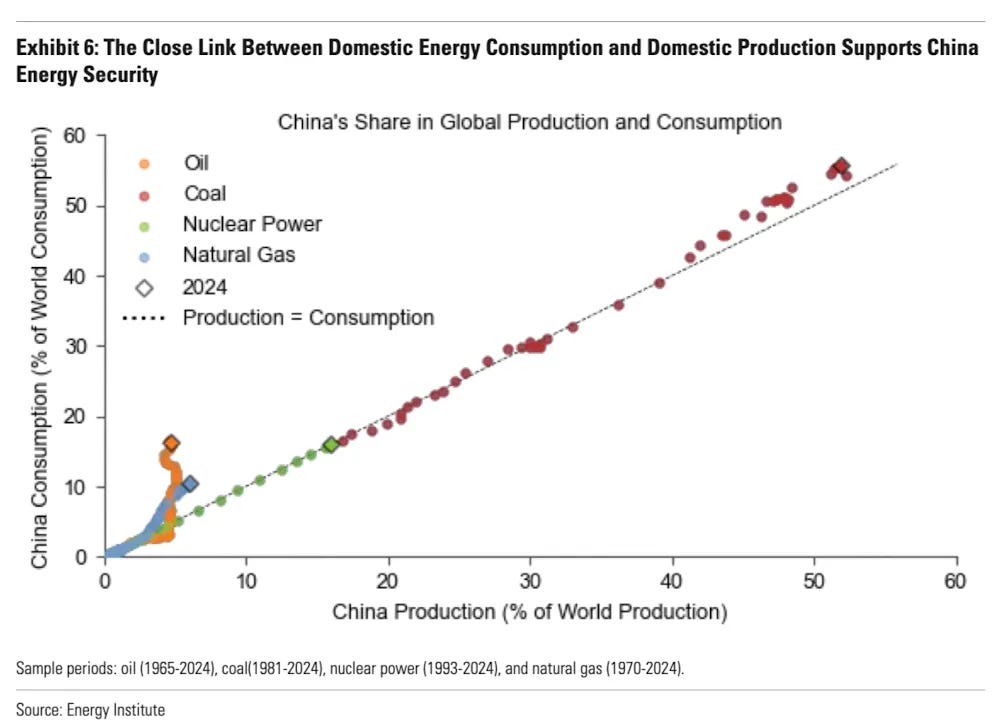

Lacking abundant domestic oil and natural gas reserves, China is actively redirecting its energy supply priorities toward domains it can control.

This involves, on one front, scaling up domestic coal production, and on the other, harnessing its command over metal resources to aggressively advance renewable energy development (see Figure 6).

Consequently, while China's drive toward electrification may appear as a green transformation, the concurrent expansion of high-emission coal-fired power plants underscores that it is foremost an energy security imperative.

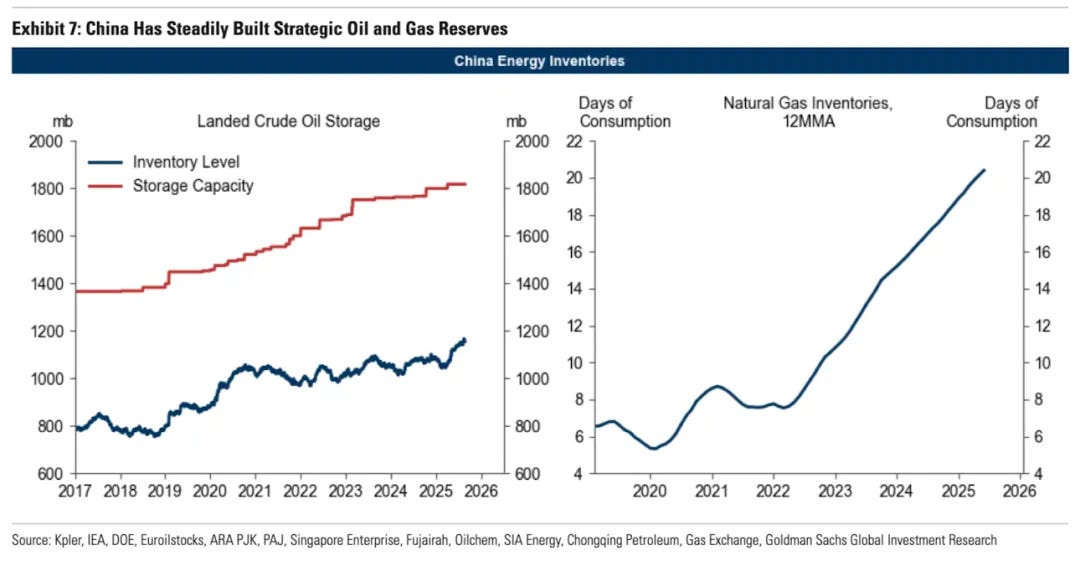

When domestic production or alternatives fall short of delivering adequate supply security, governments pivot to stockpiling.

Figure 7 illustrates how China has been methodically building strategic reserves of petroleum and natural gas. Concurrently, central banks have ramped up gold acquisitions, positioning them as a financial bulwark.

Since 2022, when $300 billion in Russian central bank assets were frozen amid the Ukraine war, the pace of gold purchases has surged more than fivefold.

The rationale for this approach is straightforward: after all, gold held domestically stands as the sole asset impervious to freezing by external powers.

Accordingly, during this "protection" phase—whether triggered by the imposition of local tariff barriers or by a global rush to accumulate reserves—commodity prices exhibit a general upward trajectory.

Expansion

Once domestic production volumes expand and achieve security, surplus output is directed toward exports. During this phase, supplies grow more concentrated, whether by design or as an unintended consequence.

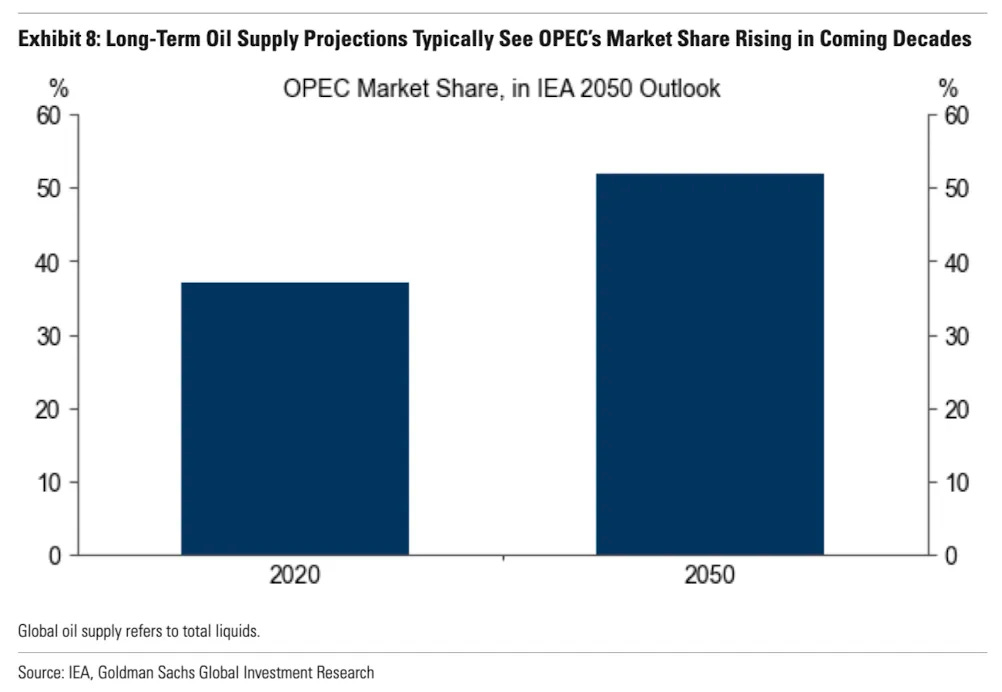

In the oil arena, select members of OPEC+ have pivoted their approach this year, transitioning from withholding barrels from the market—spare capacity, defined as oil that could be extracted but is intentionally held back—to a measured release of those reserves.

This maneuver could reclaim market share at the cost of U.S. shale production, which ballooned in the wake of the shale revolution that commenced in 2008 but is projected to decelerate over the current decade.

The majority of long-term oil supply projections, encompassing those from the International Energy Agency (IEA) and OPEC itself, generally regard OPEC as the principal driver of supply growth in the decades ahead, thereby cementing its position as the foremost swing producer (see Figure 8).

In the natural gas domain, America's shale gas revolution has generated vast production volumes that far outstrip domestic market absorption, rendering exports an inescapable imperative.

Since natural gas cannot be transported overseas via pipelines, new export terminals are required to chill it into liquefied natural gas (LNG) form for shipment by tankers.

As additional export terminals progressively come online, U.S. LNG exports have expanded rapidly. This has not only precipitated a global oversupply of natural gas but also substantially elevated America's market share in Europe and Asia (see Figure 9).

Supply expansions often depress prices in the short term, but lower prices come with greater control.

Concentration

In the case of lithium, China's shift toward electrification has driven a surge in demand, as lithium serves as a key input for electric vehicles and renewable energy storage.

Lithium prices rose eightfold between 2021 and 2022, but investments in mining and processing led by China have expanded supply, triggering a price drop of over 80% since 2023.

The rapid development of low-cost Chinese refining capacity has positioned China to dominate the global lithium refining market with a 70% share.

China controls more than 90% of global rare earth refining—a dominance that echoes former Chinese leader Deng Xiaoping's 1992 remark: "The Middle East has oil; China has rare earths."

Rare earths underpin advanced manufacturing—for instance, gallium is critical to semiconductors, including high-performance chips used in artificial intelligence, placing it at the heart of the global AI race.

China's near-total dominance in rare earth refining not only stems from sustained investments but also from the highly polluting nature of the refining process, which has led many Western countries to opt out of such activities within their borders.

Diplomacy can also shape concentration levels. The U.S. government increasingly ties energy exports to foreign policy objectives—a strategy that heightens allies' reliance on American supplies.

For instance, amid tariff negotiations, the United States has pursued agreements with Europe and India to boost purchases of American oil and natural gas.

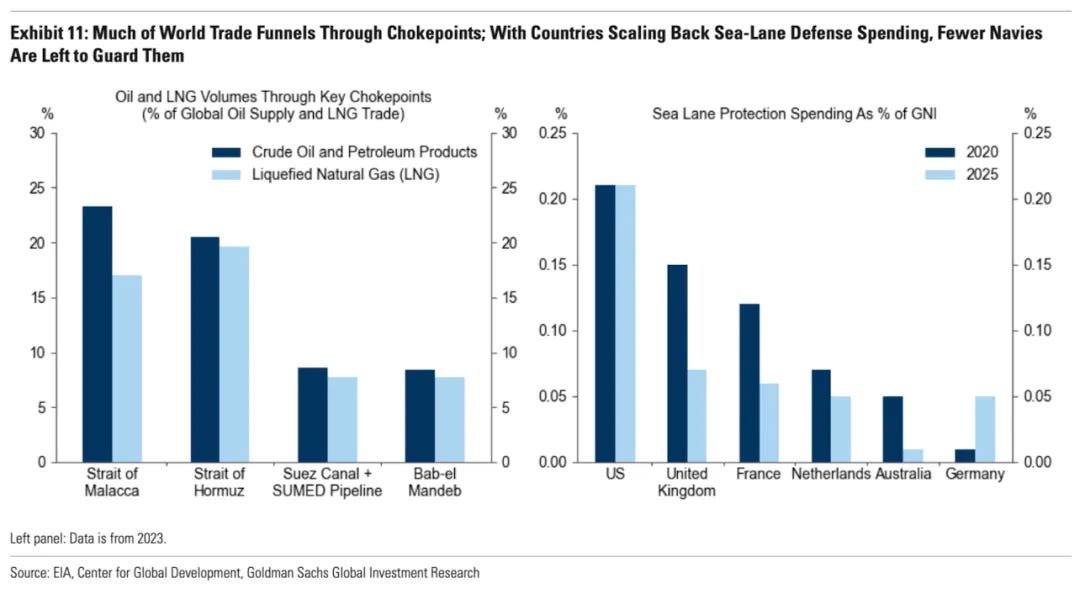

Geography likewise concentrates commodity flows. Goods are typically shipped by sea, with routes often passing through narrow straits that handle a substantial portion of global trade.

About one-fifth of the world's oil transits the Strait of Hormuz.

The Malacca Strait serves as the primary passage between the Indian and Pacific Oceans—a critical chokepoint for China, as roughly 70% of its imported oil passes through it.

The Bab el-Mandeb Strait links the Red Sea to the Indian Ocean, while the Suez Canal connects Asia to Europe.

In the Americas, the Panama Canal plays a comparable role—as a vital transit route for U.S. liquefied natural gas (LNG) and liquefied petroleum gas (LPG).

The U.S. government has characterized it as "operated by China" and has discussed efforts to "take back" the canal. Together, these routes manage a substantial share of global trade.

However, safeguards for maritime routes are eroding: U.S. allies, including the United Kingdom, Australia, and France, have curtailed naval expenditures on defending sea lanes, resulting in a diminution of naval forces tasked with protecting these pathways.

As supplies become mainly consolidated among a handful of producers and transportation must navigate ever-tighter chokepoints, vulnerabilities are intensifying.

Leverage

In 1973, Arab nations accounted for nearly 40% of global crude oil production and imposed restrictions on exports to the United States and Europe in response to their support for Israel during the Yom Kippur War, driving oil prices from $3 per barrel to nearly $12.

In 2010, China dramatically reduced rare earth exports to Japan amid a maritime dispute. In 2022, Russia provided approximately 40% of Europe's natural gas but markedly curtailed flows that year.

In reality, these cutbacks had commenced as early as 2021, when Russia constrained spot natural gas supplies and diminished deliveries via the Ukrainian and Yamal pipelines (running through Belarus and Poland to Germany).

At the time, Russia was seeking German certification for the Nord Stream 2 pipeline to transport natural gas directly to Germany, alongside additional long-term natural gas supply agreements, in order to protect its market share in Europe against the backdrop of expanding U.S. liquefied natural gas exports.

More recently, we have observed China's temporary restrictions on rare earth exports to the United States—these materials are widely utilized in high-technology sectors—leading to brief shutdowns in U.S. automotive production.

The strategic use of essential resources as leverage, combined with the accompanying risks of supply chain interruptions, often motivates other nations to adopt strategies aimed at securing their own supply networks.

For example, following the 1973 oil embargo imposed by Arab countries, the United States enacted a prohibition on exporting its domestically produced crude oil—a measure that persisted until its repeal in 2015.

In a parallel development, China's recent employment of critical minerals as negotiating leverage in diplomatic discussions may spur the United States to pursue responsive actions.

On one front, the U.S. is strengthening its internal refining capabilities through investments in domestic companies like MP Materials; on another, it is actively working to diversify its upstream supply channels.

Former Canadian Prime Minister Trudeau once remarked that Canada's abundance of critical minerals... could be the reason the United States keeps raising the idea of absorbing (Canada).

Similarly, U.S. President Trump expressed interest in Greenland, with its rich deposits of critical minerals, hoping the island might "become part of the United States."

Additionally, former White House National Security Advisor Mike Waltz emphasized earlier this year the necessity for Ukraine to forge agreements concerning its critical mineral resources.

In an age where commodity supplies are growing increasingly concentrated and subject to geopolitical leverage, investors can no longer limit themselves to conventional stock and bond portfolios but must proactively adopt strategies that incorporate commodity diversification.

By allocating investments across sectors such as energy, industrial metals, and critical minerals, we can not only hedge effectively against inflationary pressures and supply chain disruptions but also seize new opportunities arising from the reconfiguration of the global order.

Ultimately, comprehending and navigating this "commodity control cycle" will represent the essential wisdom for constructing resilient investment portfolios in the coming decade—since in a world where national priorities prevail, commodities transcend mere resources to become instruments of power and security.