Bitter Lessons from Gold's Ferocious Surge

Exploring the Recent GVZ and Silver Volatility Extremes, My Oversights in Market Dynamics, and Integrating Political Dysfunction into a Revised Bull Market Outlook for Precious Metals

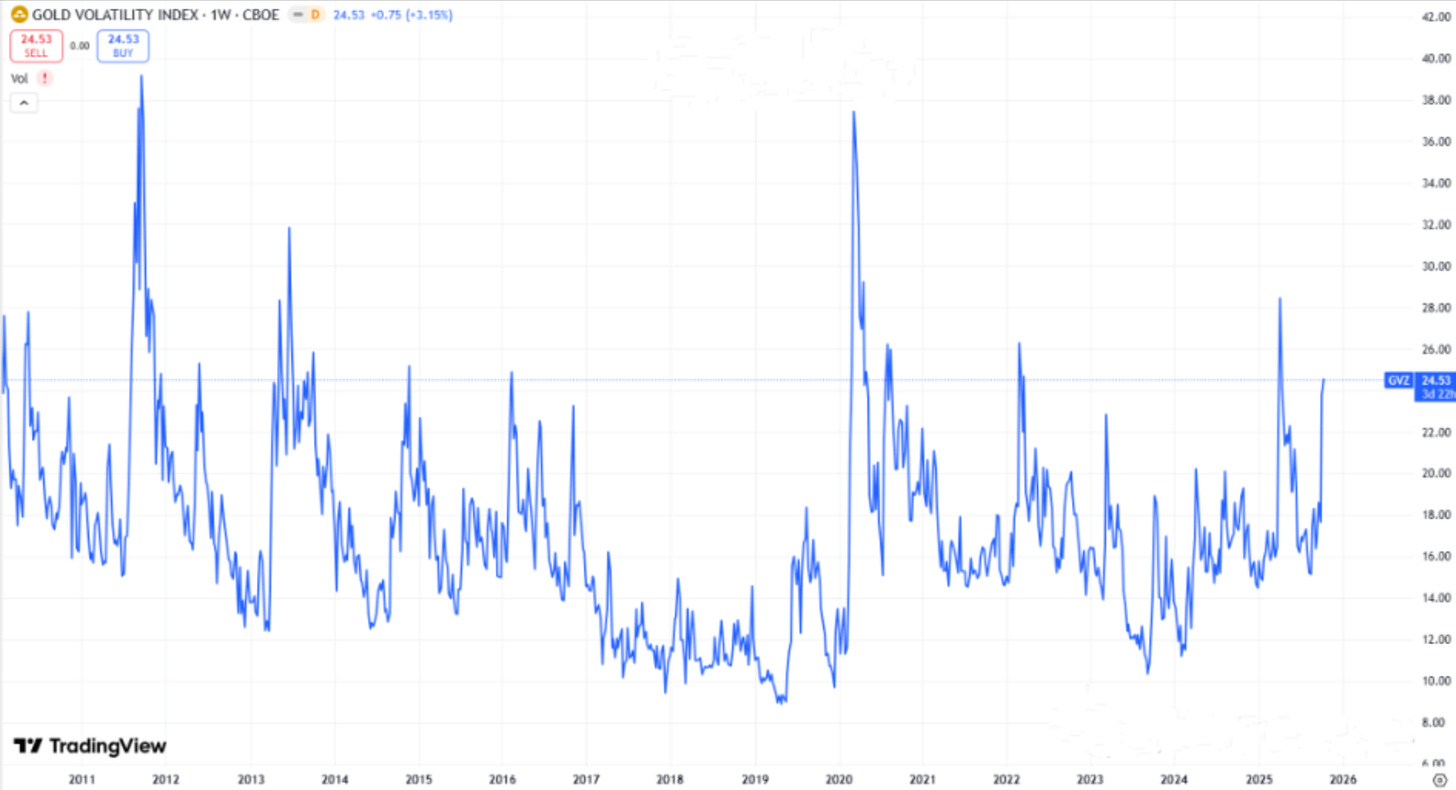

At yesterday’s close, the Gold Volatility Index (GVZ), which tracks sentiment in the gold market based on the SPDR Gold ETF, settled around 24.5—a level that’s rarely been seen in recent years.

To be more precise, since 2020, today’s gold volatility reading ranks as the third-highest peak, trailing only the period in 2022 when markets widely anticipated aggressive rate hikes from the Federal Reserve, and the shock in April 2025 triggered by tariff policies.

The current GVZ figure even surpasses the peaks seen during the Silicon Valley Bank (SVB) crisis and several rallies in 2024.

For me personally, this marks the first time in years that gold volatility has spiked this high without me holding any long positions.

This feeling is undeniably bitter, yet I harbor no regrets.

Here, I’d like to extend my congratulations to those who have held gold positions long-term, as well as to the friends who maintained their futures holdings steadfastly amid last Friday’s intense volatility, a display of extraordinary confidence and courage that I myself could not muster.

Silver’s volatility has been even more striking, which perfectly illustrates the implication behind this article’s title: the market is gripped by extreme euphoria and a ferocious upward surge.

In the current environment, predicting the future path of volatility is exceedingly difficult. It may climb even higher before any retreat.

Regardless, until market sentiment settles, this rally remains off-limits for me.

Underestimating Retail Investors’ Influence

I have little patience for those who never admit their mistakes, so I’d like to start by examining where I may have been overly cautious in the past, leading me to misjudge the market’s trajectory.

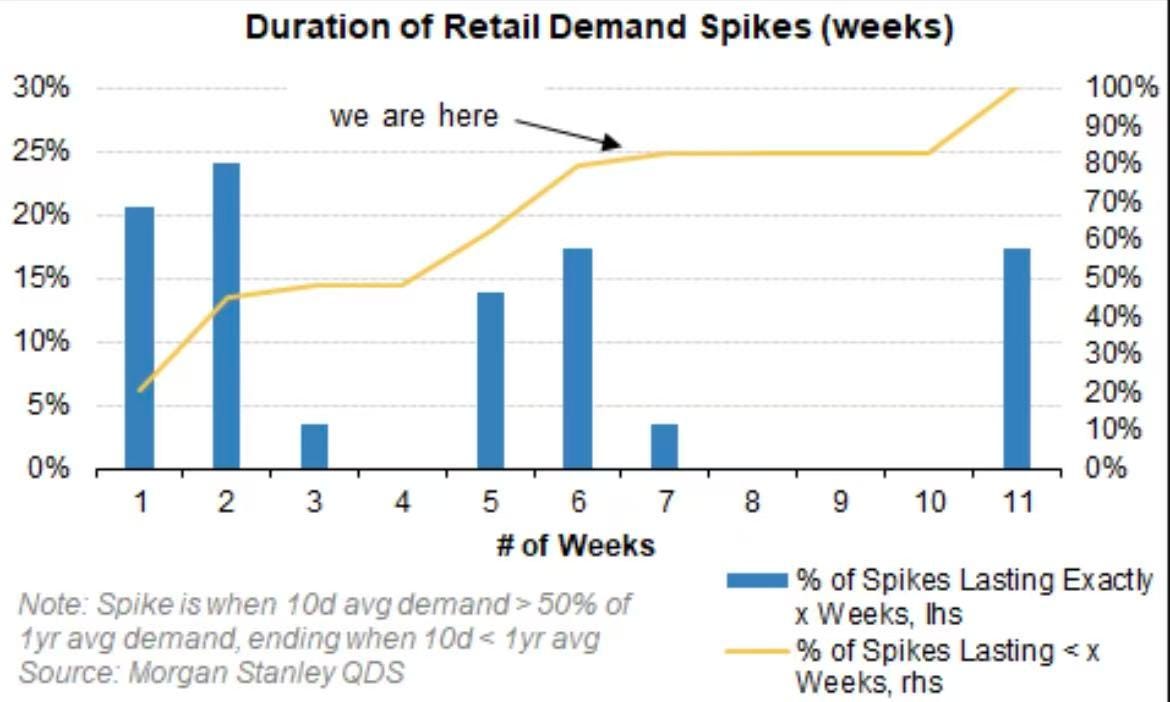

First, I underestimated the influence of retail investors. In this rally, whether it was the massive inflows into silver ETFs that disrupted the London spot market or the frantic buying on the dip by U.S. investors this Monday following last Friday’s stock downturn, the underlying force in both cases highlights the substantial power of individual traders.

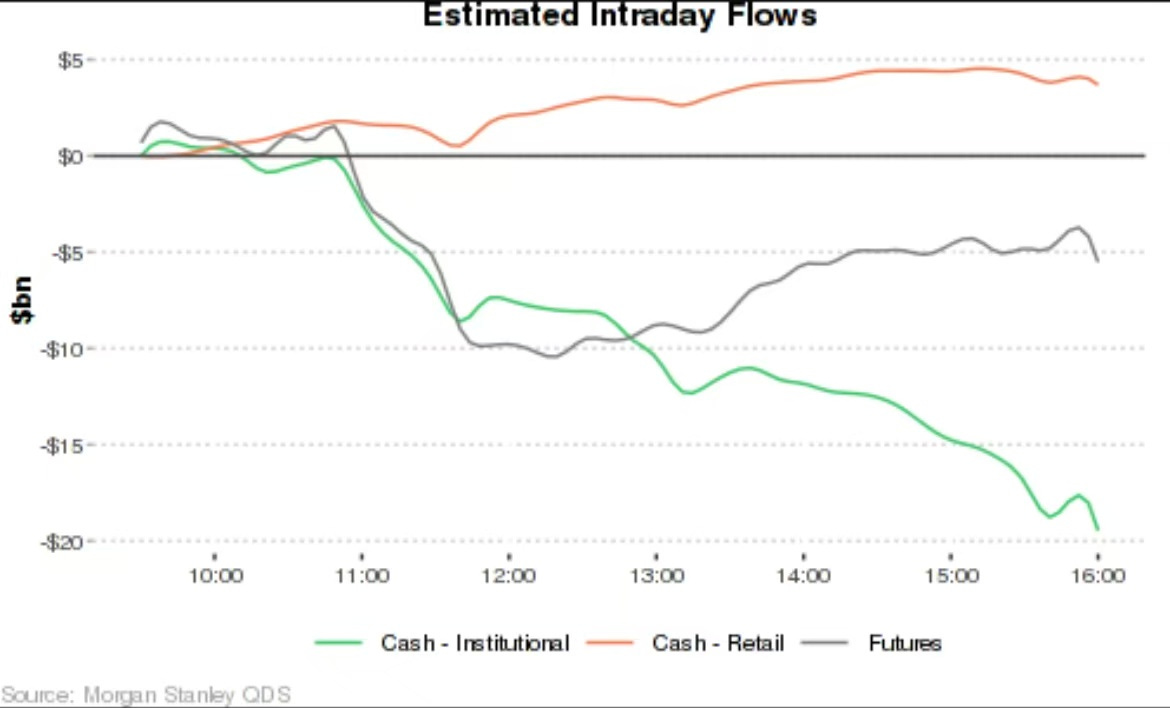

In the equity markets, intraday data from last Friday reveals that retail trading activity was even more aggressive than that of institutional investors.

What I regret most in this regard is that similar events had unfolded twice before, yet when it mattered, I did not fully appreciate the pattern—an oversight that is truly unfortunate.

Whether in April of this year or earlier last year, the U.S. stock market exhibited comparable dynamics: retail investors typically buy during pullbacks, while institutional investors, having liquidated positions amid abrupt disruptions, frequently struggle to identify opportune re-entry points.

This summer in Hong Kong and New York, I shared some detailed observations on this matter with a number of friends.

A portion of America’s working-class population truly has nothing to lose.

They show little concern over their investments becoming holding investments at a short-term loss—after all, U.S. equities have seldom disappointed long-term holders in recent years.

By contrast, their greater fear is the erosion of purchasing power due to high inflation, which might render them unable to pay their bills.

Consequently, they perceive every market downturn as an ideal entry point.

Institutional investors, on the other hand, must account for a multitude of considerations, with far too much “on the line,” which ironically leads them to adopt a more conservative stance at critical junctures.

From my perspective, the market dynamics observed last Friday and this Monday represent a condensed replay of the patterns seen in April and May of this year.

Friday’s activity echoed the retail accumulation during April’s dips, whereas Monday resembled the institutional compulsion to pursue higher prices in May.

Although Trump’s response was indeed a contributing factor, the underlying logic of market behavior remains plainly evident.

What I regret most profoundly is my failure to link two distinct observations: My earlier assessment held that institutional investors, exemplified by COMEX net long positions, tend to establish holdings in anticipation of rate cuts, while retail investors generally enter the market following such reductions.

However, I neglected to integrate this insight with the latent strength of retail participants, thereby underestimating the remarkable buying power they can exert across various asset classes, a phenomenon that holds true for the U.S. equity markets as well.

Prioritizing Copper Over Gold: A Strategic Review

Second, this point is less a mistake than a less-than-optimal strategic decision. At the time, I did anticipate that rate cuts would usher in a “soft landing” for the markets, and accordingly, I prioritized copper ahead of gold in my asset hierarchy.

My approach was heavily influenced by the market dynamics observed from July to November 2019, which led me, in early October, to favor long positions in copper over gold.

This was not an incorrect choice per se, as copper prices did eventually climb to my preset targets, yet it is nonetheless a decision that merits closer scrutiny.

First, relative to 2019, the investment framework for gold in 2025 has shifted markedly.

Second, I harbored considerable internal reservations at the time.

Historical trends indicate that gold’s advances are largely clustered in the spring (driven by expectations of rate reductions) and fall (fueled by fiscal policy anticipations).

At the time, my rationale was that the U.S. government would be unlikely to stand idly by amid risks of an economic recession, combined with the robust breakout in the copper market prior to October, marked by rising open interest, which ultimately swayed me toward copper.

As mentioned earlier, this proved to be a sound trade on its own merits, yet the U.S. government’s shutdown on October 1, coupled with the still-unresolved partisan conflicts, underscores the need for me to monitor issues of governmental dysfunction more vigilantly going forward.

Of particular significance, I am increasingly convinced that this political dysfunction represents an impending “gray rhino.”

Much of the political gridlock and turmoil evident in the U.S. today would have seemed inconceivable mere months ago, let alone several years prior.

Revising My Analytical Framework

In summary, my prior analytical framework requires the following revisions:

From a long-term perspective, I remain convinced that gold is entrenched in a structural bull market, given the unaltered dynamics of U.S.-China strategic competition—this aspect needs no adjustment.

In the medium term, my focus was primarily on the U.S. deficit ratio. In hindsight, this viewpoint must be supplemented with two key elements:

first, under the prevailing conditions of U.S. political polarization, the nation’s economic recovery trajectory may prove more erratic than in previous cycles.

Second, beyond the United States, the fiscal deficits of other major economies, such as Japan and Europe, should also be incorporated into the monitoring scope.In the short term, I focused on tracking capital flows but paid clearly insufficient attention to retail investor funds. This represents a profoundly regrettable oversight, particularly since I had referenced this phenomenon on multiple occasions yet failed to accord it adequate weight in my decision-making process.

Once gold’s volatility eventually subsides and prices settle into a new equilibrium range, these lessons must be fully integrated the next time we evaluate potential upward or downward movements.

As noted earlier, this has been a bitter episode, yet I hold no regrets. Learning from missteps is invariably advantageous, particularly when the “error” in question amounted to nothing more than diminished gains rather than actual losses.

I do regret not undertaking these reflections at an earlier juncture, a delay that may be due to my occasional laziness.

This year’s markets have presented a multitude of surprises, though they have also seemed unusually protracted. Such regrets arising from inertia are hardly novel for me, and this is an aspect that demands improvement moving forward.

I hope these insights will offer some value to you, and I genuinely welcome any constructive advice you might wish to share.

Reflecting on your missed opportunities in gold and silver made me think about how I sometimes miss chances too because I play it too safe or ignore the “small players.” Even though he calls it a “bitter experience,” I feel like learning from mistakes and adjusting your perspective is already a win, and I want to apply that kind of self-reflection to my own decisions and life.

What stands out here isn’t just the data but the humility in revisiting assumptions. Retail behavior has become a structural force, not a side effect, and ignoring that shift is where even strong models fall short.