September Showdown: Fed Cuts Meet Fiscal Innovation

White House Deploys Non-Tax Revenues to Curb Deficits as Fed Uses Monetary Tools for Stability

September kicks off with the markets in a real bind. On one hand, the Fed's almost certainly cutting rates, which should lift everyone's spirits; on the other, history's flashing a big warning sign—September's traditionally the worst month for U.S. stocks.

The confusion boils down to a major policy shift unfolding in Washington, where conventional analysis just doesn't cut it anymore. The White House is sidestepping political roadblocks with a "business-first" approach to unconventional fiscal fixes aimed at tackling the deficit mess. How's this all playing out? And why's it forcing the Fed into a controversial rate cut?

Fiscal issues are the bedrock of any serious structural reform—folks have known that for ages. Take Japan: Over the past couple decades, they've been grinding to escape deflation, but from 2006 to 2012 alone, they cycled through six prime ministers.

Plenty of leaders wanted to shake things up, but they never found a solution to the fiscal side, especially hiking the consumption tax.

The U.S. today is dealing with the exact same challenges. Trump's push for a "fiscal dominance" strategy during his presidency was driven by spotting the urgent need for structural reforms (like leveraging tech breakthroughs to fuel economic growth).

Plenty of folks scoff at Trump's "businessman mindset," but who knows—maybe that's the no-nonsense approach we need to tackle America's political and economic headaches. We'll let history be the judge on that one.

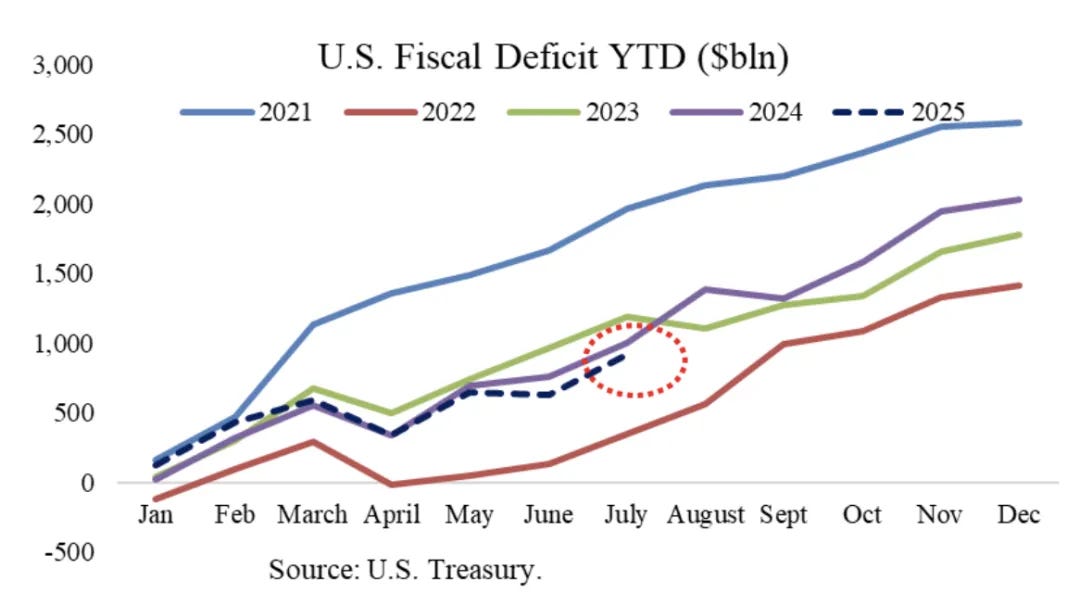

Back to the fiscal crunch the U.S. is staring down right now: in a nutshell, we're spending way more than we're bringing in. Early in his term, Trump aimed to balance the budget by slashing spending, but the pushback in the real world was too fierce.

Ultimately, projections for the Tax Cuts and Jobs Act showed it would pile on about $3.4 trillion to the deficit over the next decade. With spending cuts falling flat, the government had no choice but to shift toward "boosting revenue."

But this isn't your traditional tax hikes; it's a fresh "non-tax approach": no bump in income tax rates, yet it still pulls in hefty dollars for the federal government. It rests on three key pillars:

First, tariffs.

Tariffs are basically a spread-out consumption tax. They're regressive—hitting lower-income families harder—but the Congressional Budget Office (CBO) figures that tariff revenues could shave off about $4 trillion from the deficit over the next decade.

From a macro perspective, tariffs not only rein in overconsumption by households with a high marginal propensity to consume (MPC) and help dial back inflation, but they also deliver straight-up cash flow to the government's coffers.

Second, the government snagging minority stakes in strategic companies.

This isn't "socialism"—it's more like Singapore's sovereign investment model. The White House dumped $8.9 billion into Intel to grab about a 10% equity slice, and this could roll out to firms like Lockheed Martin that lean heavily on federal contracts.

Through these stakes, the government taps into dividends, buybacks, and capital gains, funneling some of the upside back to taxpayers.

Third, monetizing intellectual property (IP).

The government's using levers like the Bayh-Dole Act's "march-in rights" to put the squeeze on pharma and tech industries, and looking ahead, it might amp up with patent fees, enforcement, and value-based charges to pull in fiscal revenue from IP.

It's an "early lever," but the potential is off the charts.

These three moves—tariffs, equity dividends, IP fees—add up to a "revenue trilogy." They sidestep jacking up income taxes outright (the top 1% already shoulder nearly half the load, and the political pushback against doing it would be brutal), while still spinning up fresh cash flows for the government.

Spending Side Strategies

On the spending side, the Trump administration's not sitting idle either:

Mass deportations of undocumented immigrants to dial back the long-term drag on welfare and public services.

They've floated the idea that once the Russia-Ukraine war winds down, they could jump into arms control negotiations with China and Russia, potentially slashing defense spending by up to 50%.

These offbeat strategies are sparking all kinds of controversy—you can't overlook the regressive punch from tariffs, the geopolitical wild cards, or how companies might push back.

But they really spotlight the upside of that "deal-maker" mindset: breaking free from the same old tax hikes and budget cuts to scout out smarter ways to square the fiscal circle. Whether it actually delivers? We'll see what the future numbers say.

For now, at least, federal outlays are holding pretty steady compared to last year (no real slashing going on), which is helping keep the economy humming. But as a hedge, Trump's angling for the Fed to match with a 1% rate cut to lighten the load on the budget and the overall economy.

That's putting the Fed under political pressure that's not just off the charts—it's downright intense.

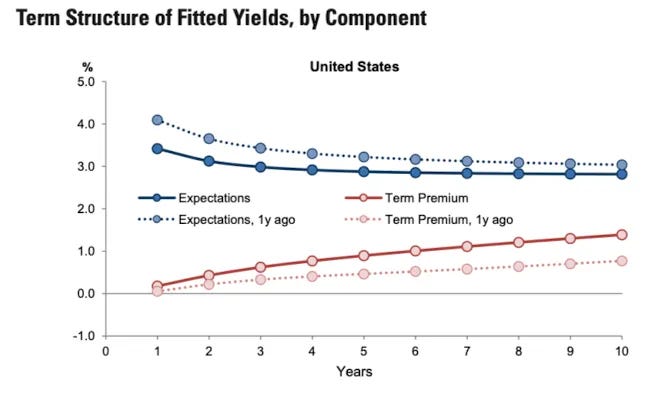

The adverse consequence is that while a September rate cut is all but certain, there is widespread concern in the market that the move will be seen as "politicized" or even "unwarranted," leading to a steeper Treasury yield curve and higher long-end interest rates.

And since those long-end rates basically dictate mortgage rates, it'd gut a big chunk of the economic juice Trump is banking on from the cut.

But, that's just the conventional wisdom. Truth is, the Fed and Treasury have plenty of tricks left to dial down yields across the maturity spectrum if push comes to shove:

A Beefed-up Version of Operation Twist

Right now, the Fed's balance sheet is heavy on short-term Treasuries.

If they dump the 3-year-and-under stuff, that could unlock around $1.2 trillion in firepower, then redirect it all into snapping up 20-year-plus bonds—potentially acquiring up to 50% of the outstanding bonds in that maturity segment.

In addition, they could pare back Treasuries and bulk up on mortgage-backed securities (MBS) to straight-up narrow mortgage spreads.

Yield Curve Control (YCC)

The U.S. hasn't gone there with YCC just yet, but the Fed has deployed all sorts of unconventional tools during past crises.

This administration's approach jacks up the chances, too—think outright pinning down long-end yield targets and backing them with bottomless bond purchases.

Aligning with Inflows into Dollar Stablecoins

If the predictions pan out and we're talking $3 trillion flooding into USD stablecoins in the coming years, Treasury could adapt to this demand by cranking out more short-term T-bills, pulling back on long-bond issuance, or teaming with the Fed to sell short and buy long.

That surge in demand by itself would weigh on long-end yields.

As long as the Treasury and the Fed are on board, they can effectively keep long-end yields in check with twist operations, rejigging the debt maturity structure, or even yield curve control—knocking out those market worries and supercharging how rate cuts actually ripple through the economy.

In a nutshell, the U.S. economy might hit a few bumps in the road short-term (which could ironically help tee up those cuts, even if the effects take a quarter to really kick in), but we can all be a little more bullish on the year ahead.

This matters not just for U.S. stocks, but for European and Japanese markets too—the U.S. is their top export destination.

All in all, we're witnessing a gutsy experiment in "fiscal dominance with monetary backup."

The White House's new strategy for ramping up revenue and reining in spending is the star of the show, while the Fed's rate cuts provide the crucial assist.

Although the market is skeptical of this unconventional approach, fearing that the side effects of a rate cut could cause long-end rates to spiral out of control, the core logic is that policymakers possess both the resolve and sufficient tools to suppress them.

Therefore the key takeaway: "Expect some short-term turbulence, but stay cautiously optimistic for the next year."

Market Signals to Monitor

With that macro backdrop in mind, here are a few market signals worth tracking this week—they'll give us some sharper insights and help figure out where things might head in the near term.

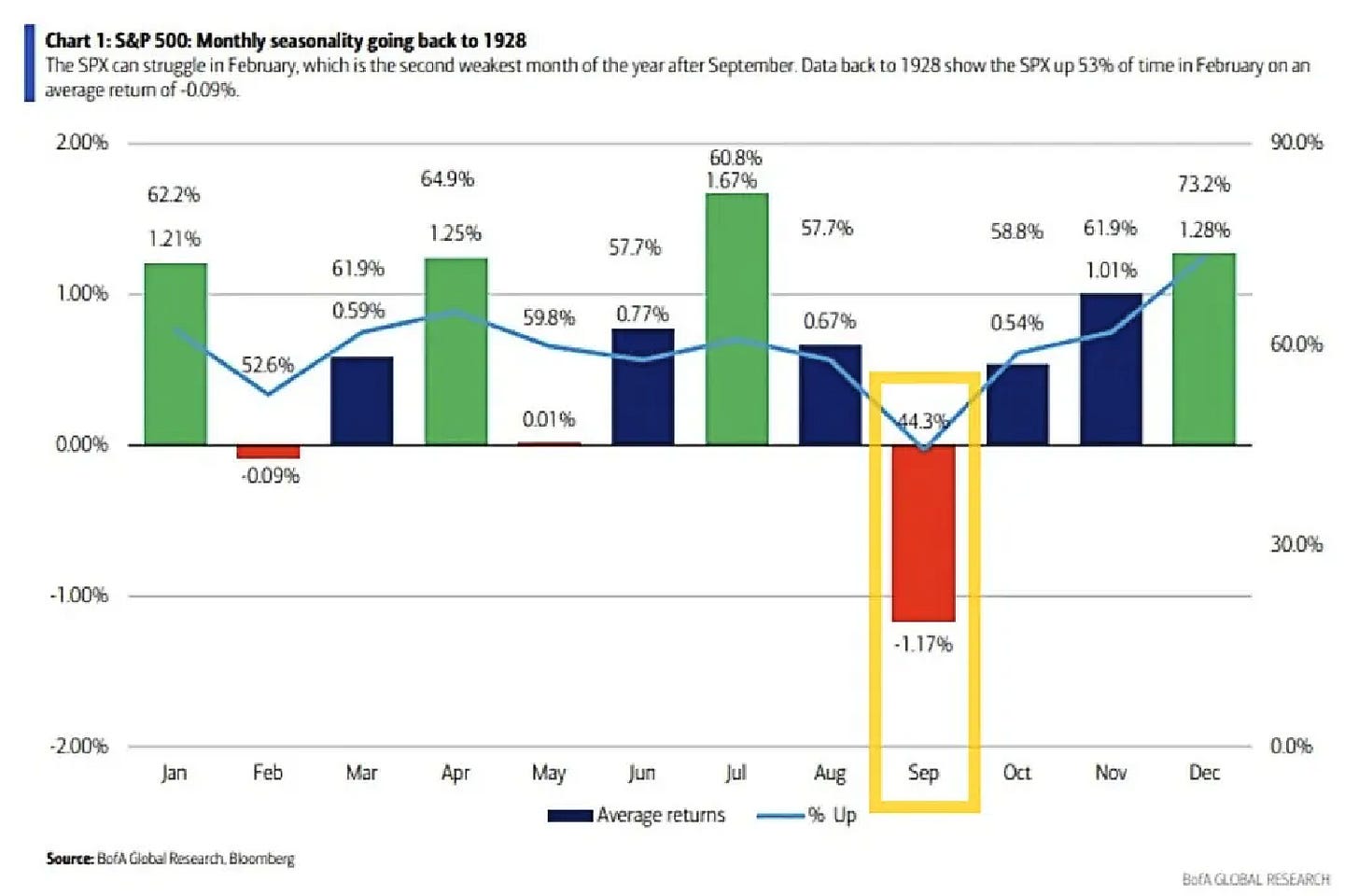

1.Dating back to 1928, September has hands-down been the S&P 500's (SPX) toughest month of the year, with an average drop of 1.17% and just a 44.3% chance of ending in positive territory.

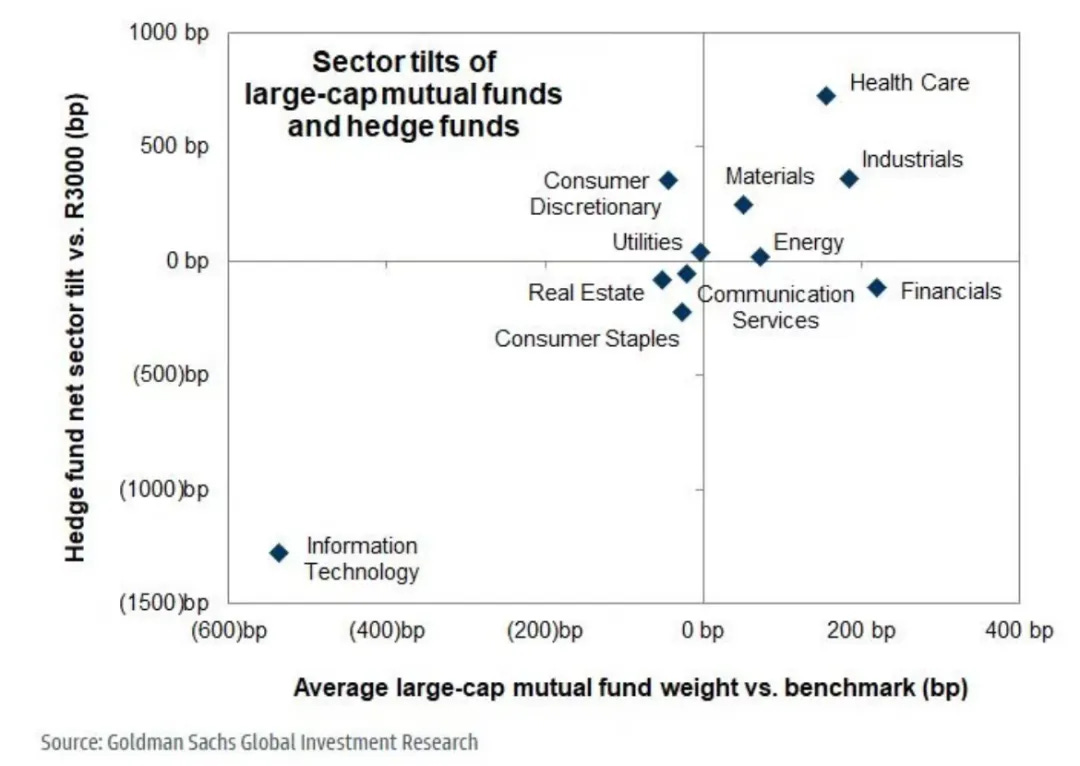

2.Right now, institutional positioning tells us that even with tech putting up strong numbers, it's underweight across hedge funds and mutual funds alike.

Meanwhile, sectors primed to win from dipping rates and climbing inflation—like health care, industrials, materials, and energy—are overweight all around.

Besides, the last couple of weeks' action lines up: defensives are holding up better than growth, and small-caps are leaving large-caps in the dust.

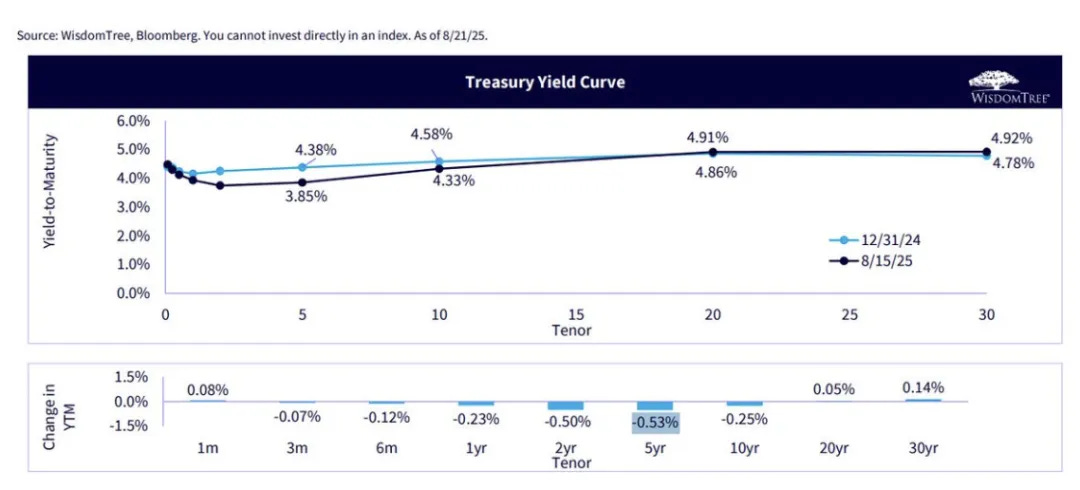

3.As the Treasury yield curve keeps steepening, intermediate-duration bonds are poised to outperform the pack. For one, they offer attractive coupon yields. Secondly, compared to 30-year Treasuries, they are far less exposed to a sharp rise in long-term rates. And versus those 1-2 year shorts, they'll soak up more benefits from any rate-cutting cycle on the horizon.

The data tells the story: Year-to-date (YTD), 5-year Treasury yields have dipped 53 basis points (the largest decline across all maturities), while 30-year yields have actually edged up 14 bps.

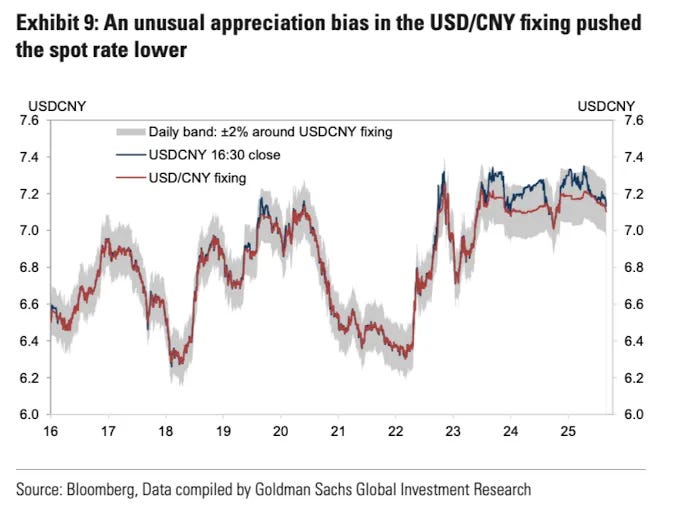

4.Goldman Sachs: The RMB's recent appreciation reflects two factors:

Broad-based US dollar weakness from July to August, as the market priced in a more dovish stance from the Federal Reserve.

A valuation catch-up, actively guided by the PBoC's management of the USD/CNY exchange rate. This managed appreciation helps correct the RMB's prior underperformance—which stemmed from a wide Sino-US interest rate differential that deterred investors—while preventing more volatile swings in the future.

On top of the policy boosts, a couple other drivers are worth keeping an eye on:

A pickup in foreign exchange settlement ratios, signaling that exporters are stepping up their game on settling FX or hedging risks.

Strong stock returns pulling in capital through channels like Stock Connect.

Plus, the yuan's uptick could be Beijing's olive branch during trade talks with the U.S. Looking ahead, we're forecasting the USD/CNY spot rate to hit 7.0 by year's end.

The dance between fiscal policy and market forces reminds us that even in complexity, careful planning and measured action matter. Watching how leaders navigate these challenges is a lesson in patience and discernment for all of us.